Shabbir Tiles & Ceramics Limited (PSX: STCL) was incorporated in Pakistan as a public limited company in 1978. The principal activity of the company is the manufacturing and sale of tiles under the brand name “Stile”. STCL has also diversified into trading of building and installation products.

Pattern of Shareholding

As of June 30, 2023, STCL has a total of 239.32 million shares outstanding which are held by 3999 shareholders. Foreign companies have the highest stake of 54.81 percent in the company followed by the local general public holding 21.15 percent of its shares. Modarabas & Mutual funds account for 12.42 percent of the outstanding shares of STCL. Around 3.1 percent of the company’s shares are held by its Directors and their spouses and minor children. Thal Limited, which is an associated company of STCL, owns 1.3 percent of its shares. The remaining ownership is distributed among other categories of shareholders.

Financial Performance (2019-24)

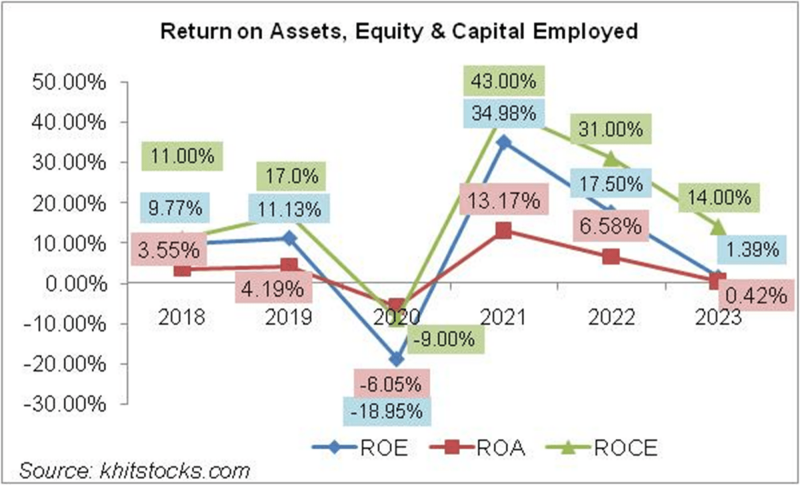

Barring a drop in 2020, STCL’s topline has been posting decent growth over the period under consideration. Conversely, its bottom line couldn’t follow suit and appreciated in just three years – 2019, 2021, and 2024. The margins of the company have been oscillating over the period under consideration. In 2019, gross and operating margins ascended while net margins stayed constant. In the subsequent year marked by COVID-19, all the margins plunged. In fact, operating and net margins entered negative territory in 2020. 2021 appears to be a healing year for STCL whereby all its margins attained their optimum levels. However, the recovery didn’t prove to be sustainable as 2022 and 2023 saw steep declines in margins. In 2024, the margins posted an uptick (see the graph of profitability ratios). The detailed performance overview underscoring the reasons for STCL’s financial performance over the period under consideration is given below.

In 2019, STCL’s topline grew by 20.22 percent year-on-year which was on account of improved product ranges, rigorous market penetration as well as capacity enhancement during the year to meet additional demand. STCL’s rated capacity increased from 12.76 million square meters in 2018 to 14.04 million square meters in 2019. Upward price revision across various categories to counter the high cost of production (particularly gas tariff) also contributed to topline growth in 2019. Cost optimization and operational efficiency kept the cost in check which grew by 18 percent year-on-year resulting in a 28.21 percent year-on-year rise in gross profit with GP margin improving from 21.80 percent in 2018 to 23.25 percent in 2019. Higher freight costs on account of increased volumes and a hike in the prices of POL products pushed the distribution cost up by 23.91 percent year-on-year in 2019. Targeted advertising and sales promotion also played a role in driving up the distribution expense during the year. Higher payroll expenses on account of soaring inflation culminated in a 40.72 percent year-on-year spike in administrative expenses in 2019. STCL registered net other income of Rs.32.95 million in 2019, up 124 percent year-on-year which was on account of gain earned from the sale of scrap and operating fixed assets during the year. Operating profit measured up by 33 percent year-on-year in 2019 with OP margin climbing up to 6.63 percent versus 6 percent in 2018. Despite the high prevailing discount rate in 2019, STCL’s finance cost slid by 11.39 percent year-on-year. This was the consequence of significantly less long-term financing obtained during the year which took STCL’s gearing ratio from 31.27 percent in 2018 to 24.7 percent in 2019. The effect of prior-year taxation and deferred taxation also diluted the bottom-line growth in 2019. Net profit stood at Rs.234.34 million in 2019, up 20.54 percent year-on-year with an NP margin of 3.4 percent, almost the same as the previous year. EPS grew from Rs.0.81 in 2018 to Rs.0.98 in 2019.

STCL’s net sales lost its footing in 2020. COVID-19 put brakes on the economic as well as construction and real estate development activities in the country, leading to reduced demand for STCL’s products. Even before the outbreak of the pandemic, the market size of tiles shrank as the federal government introduced the requirement of CNIC for sale to unregistered persons coupled with the classification of tiles in the third schedule of the Sales Tax Act, of 1990. Cognizant of demand destruction, STCL produced 8.11 million square meters of product, down 22 percent year-on-year, resulting in capacity utilization of 57.76 percent in 2020 versus capacity utilization of 73.72 percent recorded in 2019. Despite tamed off-take, the cost of sales grew by 1 percent year-on-year due to a 31 percent hike in gas tariff. This combined with Pak Rupee depreciation and supply chain hindrances inflated the cost of imported raw materials and squeezed the gross profit by 31.96 percent year-on-year in 2020. GP margin drastically fell to 16.94 percent in 2019. Distribution expense surged by 11.72 percent in 2020 due to higher freight charges on account restrictions on the movement of people and goods during the lockdown period. A number of employees slid from 869 in 2019 to 766 in 2020, however, high inflation continued to fuel the payroll expense, resulting in a 2 percent growth in administrative expenses. STCL booked an allowance worth Rs.37.09 million for ECL in 2020, up 411 percent year-on-year, due to economic breakdown during the year, which increased the risk of non-payment. STCL registered net other income of Rs.38.56 million in 2020, up 17 percent year-on-year which was due to no provisioning done for WPPF in 2020. The company incurred an operating loss of Rs.193.74 million in 2020. Finance cost showed a meager 0.15 percent growth in 2020 due to significantly fewer loans obtained during the year. STCL’s gearing ratio further marched down to 18.66 percent in 2020. STCL incurred a net loss of Rs.325.77 million in 2020 with a loss per share of Rs.1.36.

STCL’s financial performance which took an ugly turn in 2020 considerably recovered in 2021 with a 52.98 percent year-on-year rebound in net sales. This was mainly due to an enhancement in construction activity during the year on account of construction stimulus packages introduced by the government coupled with accommodating monetary policy. In response to demand recovery, the company produced 12.37 million square meters of tiles, up 53 percent year-on-year. This led to 88.11 percent capacity utilization in 2021. Since STCL is a company with high fixed-cost, hence, increased capacity utilization resulted in better absorption of cost, resulting in a 179 percent year-on-year rebound in gross profit with a GP margin of 30.90 percent recorded in 2021. Distribution expense grew by 34.6 percent year-on-year in 2021 due to high freight charges on account of increased volume, higher payroll expense, and cut-throat advertising to attain greater market penetration. Administrative expenses grew by 13 percent year-on-year in 2021 on account of higher payroll expenses despite a drop in employee count from 766 in 2020 to 742 in 2021. STCL posted robust net other income of Rs.162.03 in 2021, up 320.27 percent on account of gain on re-measurement of GIDC payable. The company posted a staggering operating profit of Rs.1557.19 million in 2021 with an OP margin of 15.7 percent – the highest among all the years under consideration. Despite monetary easing and lesser borrowings, finance costs spiraled by 23.39 percent year-on-year in 2021 as a consequence of the unwinding of the finance cost of GIDC. STCL’s gearing ratio fell to 7.06 percent in 2021. Net profit stood at an impressive Rs.924.89 million in 2021 with EPS of Rs.3.86 and NP margin of 9.34 percent.

2022 also witnessed topline growth, albeit, with a lower magnitude of 20.14 percent year-on-year. This came on the back of improved product mix and price revision. The production volume ticked down to 11.9 million square meters, culminating in capacity utilization of 84.76 percent in 2022. Reduced volume was the result of high inflation and elevated discount rates which halted the construction activities in the country by restraining the purchasing power. The development spending also took a plunge in 2022 as the government was grappling against current account and fiscal slippages. Exorbitantly high energy prices as well as gas shortages also led to reduced capacity utilization during the year and also contributed towards a 30 percent year-on-year cost hike in 2022. Gross profit narrowed down by 2.13 percent year-on-year in 2022 with GP margin declining to 25.17 percent. Distribution expense posted a 14.88 percent year-on-year surge in 2022 which was due to a sharp spike in freight cost on account of elevated petroleum prices. Administrative expenses also measured up by 16.16 percent year-on-year in 2022. STCL registered net other income of Rs.85.25 million in 2022, down 47 percent year-on-year as re-measurement gain on GIDC payable was no longer recorded in 2022. Operating profit tapered by 27.91 percent year-on-year with OP margin considerably plummeting to stand at 9.43 percent in 2022. Finance cost enlarged by 7.81 percent in 2022 as the company incurred low unwinding of finance cost on GIDC and lease liabilities. STCL’s gearing ratio grew to 9.03 percent in 2022. Net profit inched down by 46.23 percent year-on-year in 2022 to clock in at Rs.497.322 million with EPS of 2.08 percent and NP margin of 4.2 percent.

The slowdown of construction activity in the country led to lackluster demand for tiles in 2023. This forced many tile manufacturers to either hold back or shut down their production activities in 2023. In such an uncertain economic backdrop, STCL’s topline showed resilience as it grew by 19.19 percent year-on-year in 2023. While the demand remained sluggish, STCL altered its sales mix and pricing strategy to maintain its sales volume at the previous year’s level. Capacity utilization stood at 85.54 percent in 2023. Topline growth couldn’t trickle down to produce a healthier bottom line amid a 25.73 percent higher cost of sales recorded in 2023. This was the consequence of Pak Rupee depreciation, unprecedented inflation, and unparalleled energy costs. This pushed the GP margin down to 21.1 percent. In absolute terms, gross profit ticked down by 0.26 percent in 2023. Distribution expense mounted by 32.91 percent in 2023 due to higher freight charges on account of a whopping upturn in diesel prices. Administrative expenses escalated by 15.14 percent in 2023 due to higher payroll expenses on account of inflationary pressure. Conversely, the workforce was squeezed from 745 employees in 2022 to 730 employees in 2023. STCL registered net other income of Rs.22.08 million in 2023, down 74.10 percent year-on-year. This was due to lesser interest income on TDRs, low dividend income from mutual funds, and higher exchange loss recorded in 2023.STCL registered a 55.62 percent decline in its operating profit in 2023 with OP margin drastically falling down to 3.51 percent. Finance cost surged by 67.19 percent in 2023 due to higher unwinding of finance cost of lease liabilities and elevated discount rate. Besides, the company’s outstanding long-term loans also increased during the year in order to finance its CAPEX and for the investment in renewable energy. STCL’s gearing ratio escalated to 18.52 percent in 2023. Net profit weakened by 92.44 percent in 2023 to clock in at Rs.37.61 million with EPS of Rs.0.16 and NP margin of 0.27 percent.

STCL recorded a 9.86 percent year-on-year uptick in its net sales in 2024. The enduring political and economic crisis took its toll on the demand for tiles due to sluggish activity in the construction sector – both individual and commercial segments. The company passed on the impact of cost hikes to its consumers by revising its prices. This resulted in a 21.17 percent year-on-year improvement in gross profit in 2024 with GP margin climbing up to 23.23 percent. Distribution expenses surged by 16.84 percent in 2024 due to heightened freight charges, axle load requirements, and high diesel prices. Administrative expenses inched up by 2.91 percent due to inflation. This was despite the fact that the company was streamlining its workforce due to reduced demand. STCL recorded net other income of Rs.94.72 million in 2024, up 328.92 percent year-on-year. While detailed financial statements are not yet available, we can assume that lower exchange loss due to stability in the value of Pak Rupee might have boosted net other income in 2024. STCL’s operating profit strengthened by 61.57 percent in 2024 with OP margin jumping up to 5.17 percent. Finance cost inched up by just 2.56 percent in 2024. This might be the result of payment of a long-term loan during the year. 9MFY24 report also shows a downtick in the company’s outstanding long-term loans. The company’s bottom line posted a staggering growth of 751.21 percent to clock in at Rs.320.17 million in 2024 with EPS of Rs.1.34 and NP margin of 2.1 percent.

Future Outlook

Near-term stability in the economic parameters including the downward journey of inflation and discount rate and stability in the value of the Pak Rupee are the optimistic signs. This will stimulate growth across various sectors and support GDP growth. Increased urbanization and population growth will also buttress the demand for tiles. On the flip side, exorbitant energy and gas tariffs will continue to pose challenges to the construction sector.

Read the full story at the Business Recorder - Latest News website.