Pakistan Stock Exchange (PSX) on Monday came under downward pressure from selling of selective stocks and the benchmark KSE-100 index registered a marginal decline of nearly 40 points.

The weakening of global equities and growing apprehensions about economic uncertainty in Pakistan drove the stock market down, after wiping out all the earlier gains.

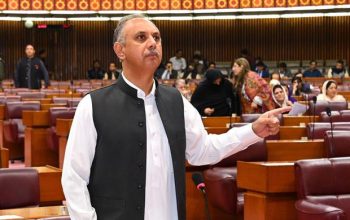

In the morning, the bourse began trading on a positive note with the momentum being fuelled by the formation of a new cabinet, whose members took oath during the day.

Prime Minister Shehbaz Sharif convened the first cabinet meeting in the evening. As a result, the market briefly crossed the 66,000 mark, reaching intra-day high at 66,119.34 points post-midday trading.

However, concerns surrounding the upcoming monetary policy announcement and the outcome of government’s negotiations for a new International Monetary Fund (IMF) loan package led to a shift in sentiment.

Consequently, the index struggled to maintain the 66,000 level and eventually fell to the intra-day low at 65,698.76 points right before close.

“Stocks closed under pressure amid weak global equities and concerns over economic uncertainty in the country,” said Arif Habib Corp MD Ahsan Mehanti.

“Uncertainty about monetary policy announcement on March 18 and concerns over the outcome of government negotiations for a new IMF loan played the role of catalysts in negative close of the market.”

At close, the benchmark KSE-100 index recorded a slight decrease of 38.45 points, or 0.06%, and settled at 65,755.31.

Read: With political calm, PSX advances modestly

Topline Securities Deputy Head of Sales Ali Najib, in his report, said that earlier buying momentum could be attributed to the formation of the cabinet, which took oath on Monday.

“However, 66,000 has so far proved to be a ‘quagmire area’ where bullish forces face tough competition and eventually surrendered for the fifth time since last week,” he said.

Power, fertiliser, tech, auto and pharma sectors contributed positively to the index as Hub Power, Fauji Fertiliser, Pakistan Telecommunication Company, Millat Tractors and The Searle Company added 95 points.

On the flip side, Dawood Hercules Corporation, Pakistan Services and Nestle Pakistan saw stock selling as they collectively lost 160 points, Topline added.

Arif Habib Limited (AHL) reported that there was “additional flirting with 66,000 at the commencement of the week as tech names remained strong.”

Hub Power (+1.23%), Millat Tractors (+1.18%) and Fauji Fertiliser (+0.73%) were the biggest contributors to the index’s gains, it said.

Tech names Air Link Communication (+7.5%) and Pakistan Telecommunication Company (+8.11%) were both limit up and the sector was expected to remain strong.

Other notable performers were Hascol, Hi-Tech Lubricants, Ghandhara Industries and Crescent Steel, which “has now gained 33% MTD (month to date)”.

“HBL CEO Muhammad Aurangzeb has resigned from his post and is among the 19 who took oath as ministers in PM Shehbaz’s cabinet and is the front runner for the finance ministry,” AHL report added.

Overall trading volumes increased to 548.8 million shares against Friday’s tally of 481.7 million. The value of shares traded during the day was Rs16.6 billion.

Shares of 357 companies were traded. Of these, 220 stocks closed higher, 118 dropped and 19 remained unchanged.

Cnergyico PK was the volume leader with trading in 96.5 million shares, gaining Rs0.22 to close at Rs5.11. It was followed by Hascol Petroleum with 52.3 million shares, gaining Rs0.66 to close at Rs8.50 and Kohinoor Spinning Mills with 27.3 million shares, losing Rs0.21 to close at Rs5.31.

Foreign investors were net buyers of shares worth Rs50.2 million, according to the NCCPL.

Published in The Express Tribune, March 12th, 2024.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

Read the full story at the express tribune website.