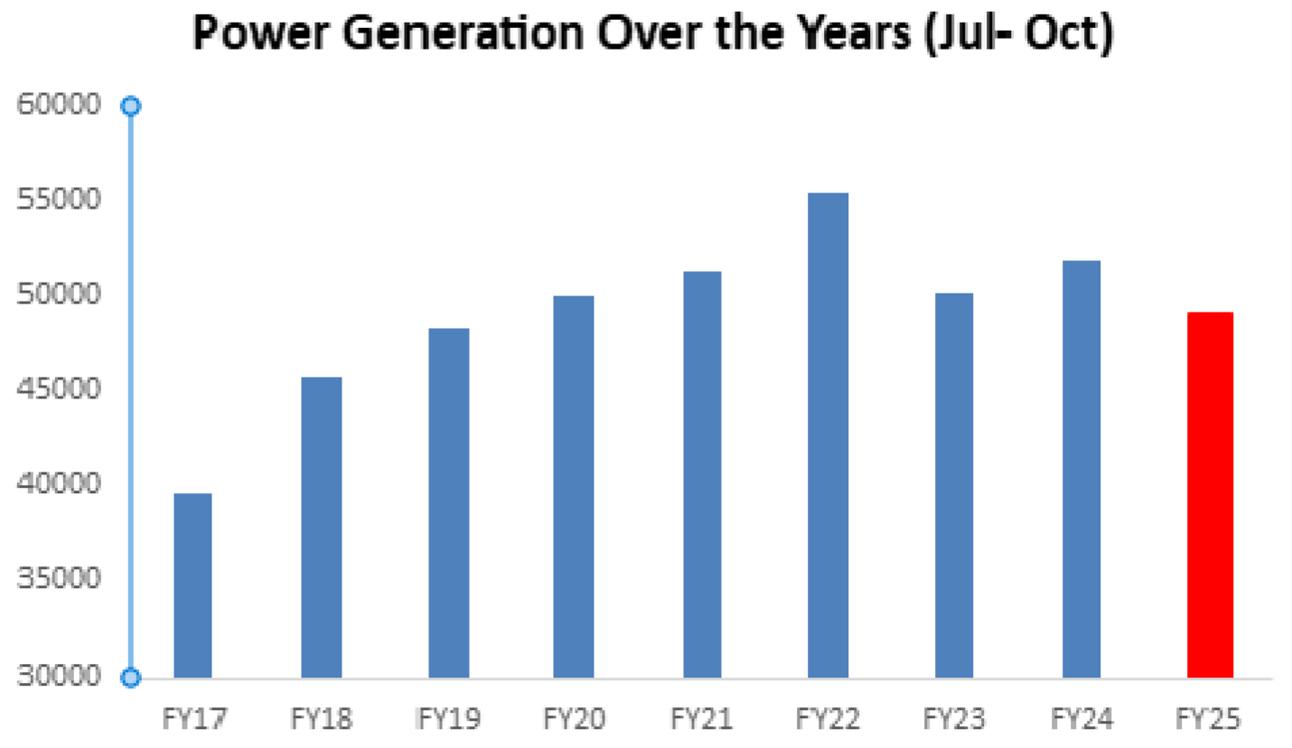

Electricity generation in October 2024 at 10 billion units has made some mistakes for the demand finally turning a corner. Granted, a nearly 8 percent year-on-year increase in electricity generation, which is also the highest increase in 14 months is a legit reason for jubilation. But it must not be forgotten it is coming on the back of a double-digit decline last year same month, which was then an 8-year low number.

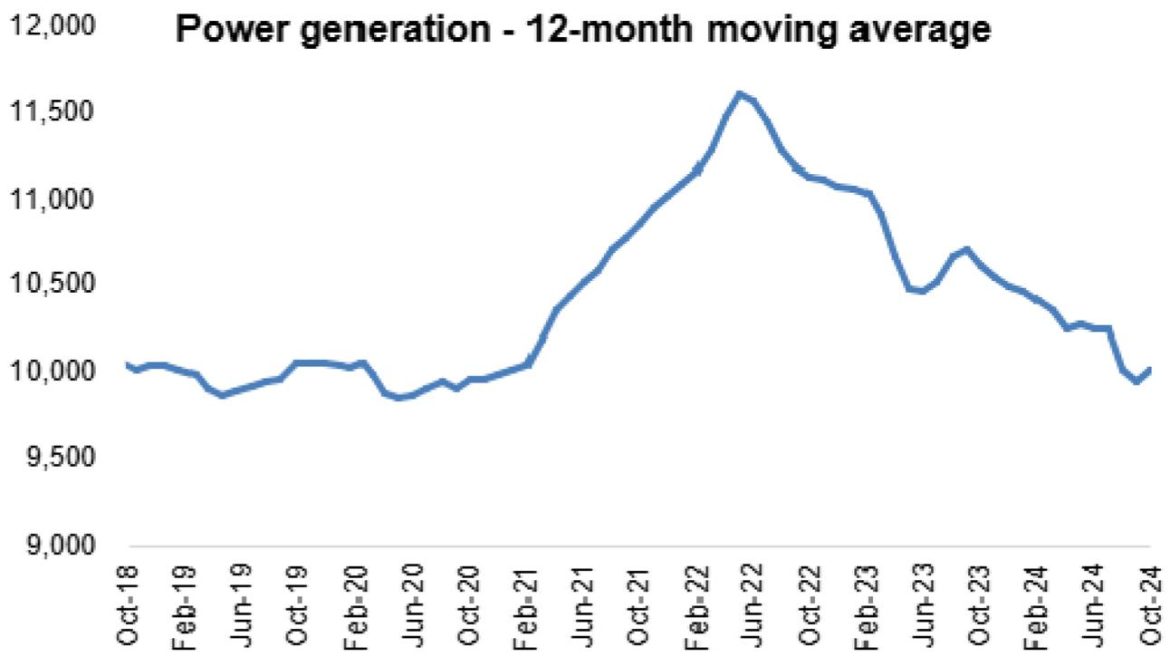

On a cumulative basis, the grid power generation at 49 billion units for 4MFY25 is still down 5 percent year-on-year and is the lowest in six years, the previous low being reported in 4MFY19. This is the third consecutive year of the 4M generation returning negative year-on-year growth and clearly tells us there is not much to rejoice in the October resurgence alone. The 4MFY25 generation is 11 percent lower from the peak of FY22 and is still 5.6 percent year-on-year on a 12-month rolling basis. Consider that September of 2018 had a higher 12-month moving average at 10 billion units. A good seven years ago.

Mind you, October 2024 was also the warmest ever October with a huge deviation of 2.48 degrees centigrade (10.5%) from average. Mean, median, and daytime, across regions – all returned the highest temperature readings ever recorded for any October in Pakistan, as per the Pakistan Metrological Department. In the context of temperatures being higher than 10.5 percent than the long-term average, an 8 percent year-on-year increase hardly instills optimism.

In a rare event, the actual monthly power generation was 1 percent higher than the reference power generation for October 2024. That said, the 4MFY25 generation is still down 9 percent from the reference generation of 54 billion units, worked out for the Power Purchase Price calculations. Continuing with the recent trend, the monthly Fuel Charges Adjustment (FCA) sought stayed in the negative zone. At negative Rs1.02/unit – this is the lowest monthly adjustment sought in nearly two years. A much more realistic reference generation mix has helped keep adjustments on the lower side, coupled with a remarkably stable PKR and international energy commodity prices.

The authorities have okayed the winter incentive package to encourage higher consumption with incremental consumption of up to 25 percent at a marginal price. The idea is worth a try (read: Bijli Sahulat Package: Worth a try, published November 13, 2024) but is not likely to drastically change the consumption patterns, unless industrial users throw a surprise. A more meaningful increase in grid consumption is slated to come from the return of captive power industrial users to the grid, as the IMF has reportedly stood firm on its stance of ending all captive power use by the end of 2024.

The massive influx of rooftop solar has already made a sizeable dent in grid generation, and there is a need to alter pricing and load strategies on that front, in addition to luring back industrial captive power users to the grid. Every unit that is generated and consumed from the grid will help slash the national average tariff, and only then will the IPP contract negotiations yield the desired result.

Read the full story at the Business Recorder - Latest News website.