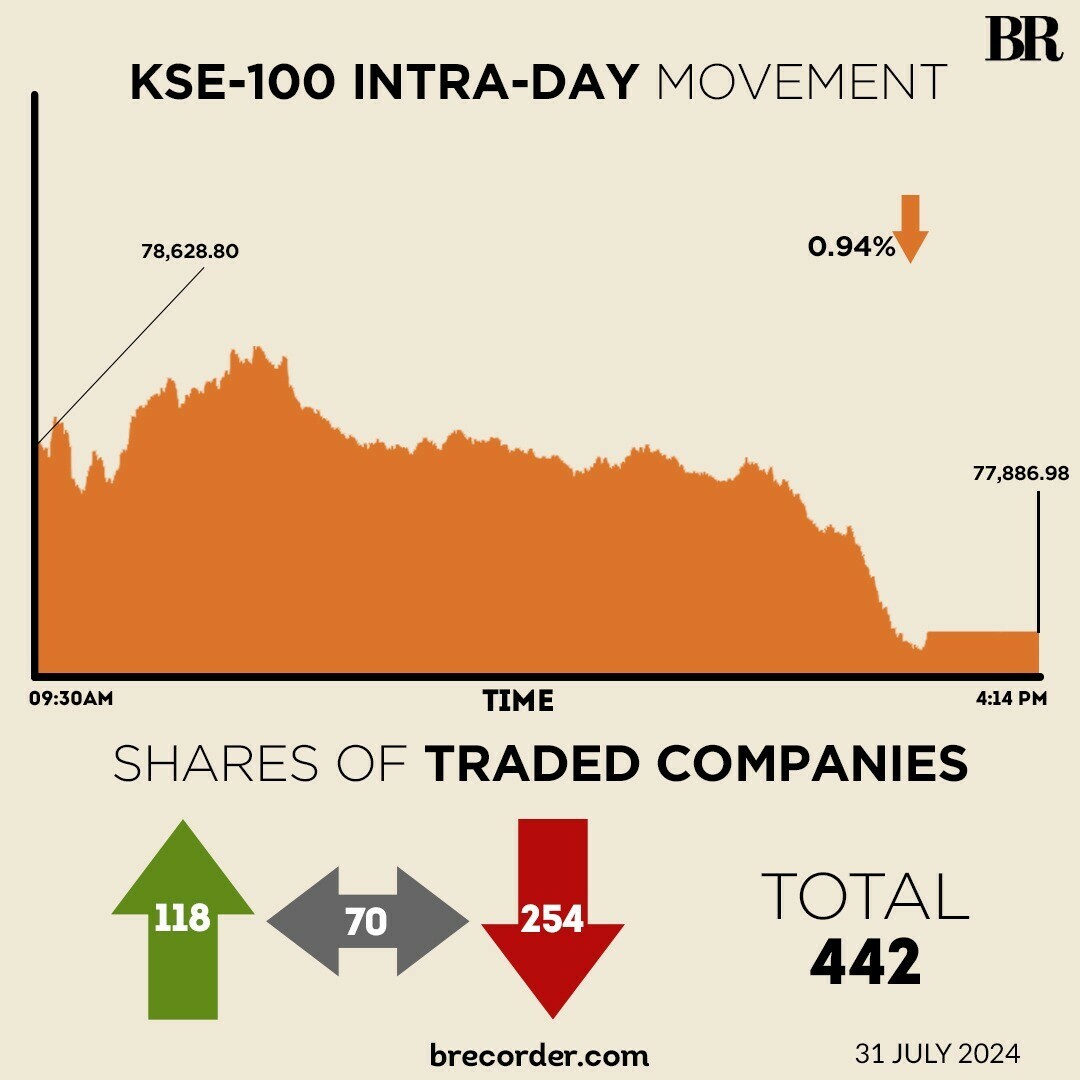

The KSE-100 suffered a dramatic fall in the final 60 minutes of trading with analysts saying that an inability to access real-time share prices led to some panic selling after Pakistan saw massive disruption in internet services on Wednesday.

The benchmark index hovered in a narrow range in the morning hours as the market grappled with the increase in oil prices after Hamas leader Ismail Haniyeh was killed in Iran.

However, it was the final hour when panic selling was witnessed amid reports of internet outage and slow connectivity, taking the index deeper into the red.

The index was seen falling from 78,529 to 77,810.16 within minutes, a fall of over 700 points.

Amid low volume, analysts also said the market was having an ‘off-day’ as investors still search for fresh positions.

A PSX official, however, said there was no trading impact due to internet outage, but a senior trader said slow connectivity did hamper the ability to conduct trades.

Another trader said there was selling pressure due to institutional selling, shrugging off concerns over internet connectivity.

At close, the KSE-100 was at 77,886.98, a fall of of 742 points or 0.94%.

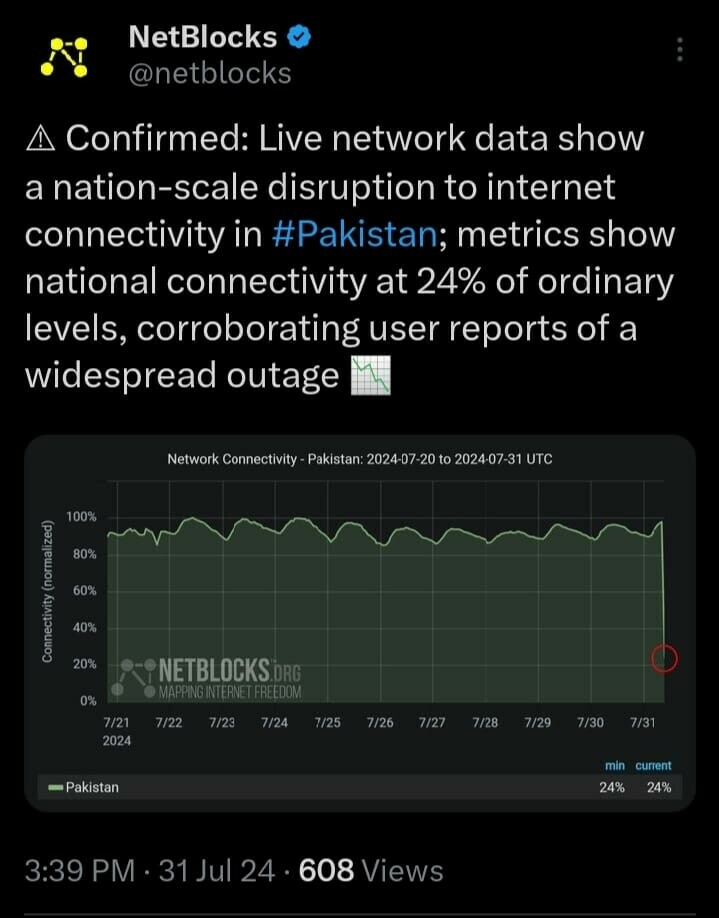

Pakistan suffered a severe connectivity issue during the afternoon with users reporting outages and sluggish speeds.

NetBlocks, a watchdog organisation that monitors cybersecurity and the governance of the internet, confirmed that there was a nation-scale disruption to internet connectivity in Pakistan.

“Metrics show national connectivity at 24% of ordinary levels, corroborating user reports of a widespread outage,” it said in a post on X.

On Tuesday, the KSE-100 fell 0.25% as investors awaited positive developments to assume fresh positions after the monetary policy announcement was largely seen as a neutral for the capital market.

Meanwhile, in a notice to the PSX, Indus Motor Company Limited (IMC), the assembler/manufacturer of Toyota-brand vehicles in Pakistan, said it had initiated the export of certain vehicles to other Toyota-affiliated companies.

“We are pleased to announce that Indus Motor Company Limited (IMC) has commenced an export activity of certain vehicles to other Toyota affiliated companies,” read the notice.

Pakistan Hotels Developers Limited (PHDL) said it had transferred title and possession of Regent Plaza, a four-star hotel in the country’s financial hub, the Sindh Institute of Urology and Transplantation (SIUT) Trust.

The development comes after SIUT Trust made the remaining 10% payment of sale value of the property, which amounts to $5.2 million, on July 30, 2024 (Tuesday), informed PHDL in a notice to the bourse.

United Bank Limited (UBL), one of the country’s largest commercial banks, posted consolidated earnings of a massive Rs15.27 billion during the quarter ending June 30, 2024, up nearly 17% from the profit-after-tax of Rs13.05 billion in the same period of the preceding year.

According to its notice to the PSX, earnings per share clocked in at Rs12.10 in 2QCY24, an increase from Rs10.39 in 2QCY23.

Globally, Asian stocks clung to familiar ranges on Wednesday after contrasting results from tech bellwether Microsoft and chipmaker AMD suggested a divide in the AI landscape while the yen was firm ahead of the Bank of Japan’s policy decision.

Central banks dominated investor attention, with the decision from the Federal Reserve also due later in the day with markets expecting the US central bank to stand pat on rates but indicate rate cuts are on the way.

MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.23% higher but on course for a 1.2% decline for the month, snapping a five-month winning streak.

The Pakistani rupee registered a marginal decline, depreciating 0.03% against the US dollar in the inter-bank market on Wednesday. At close, the currency settled at 278.74, a loss of Re0.08, against the greenback.

Volume on the all-share index increased to 382.6 million from 313.08 million a session ago.

The value of shares declined to Rs14.64 billion from Rs17.61 billion in the previous session.

WorldCall Telecom was the volume leader with 81.16 million shares, followed by Kohinoor Spining with 24.7 million shares, and TPL Properties with 19.7 million shares.

Shares of 442 companies were traded on Wednesday, of which 118 registered an increase, 254 recorded a fall, while 70 remained unchanged.

Read the full story at the Business Recorder - Latest News website.