Some buying momentum was seen at the Pakistan Stock Exchange (PSX) as its benchmark KSE-100 Index closed higher by 232 points to close at a fresh record high on Monday.

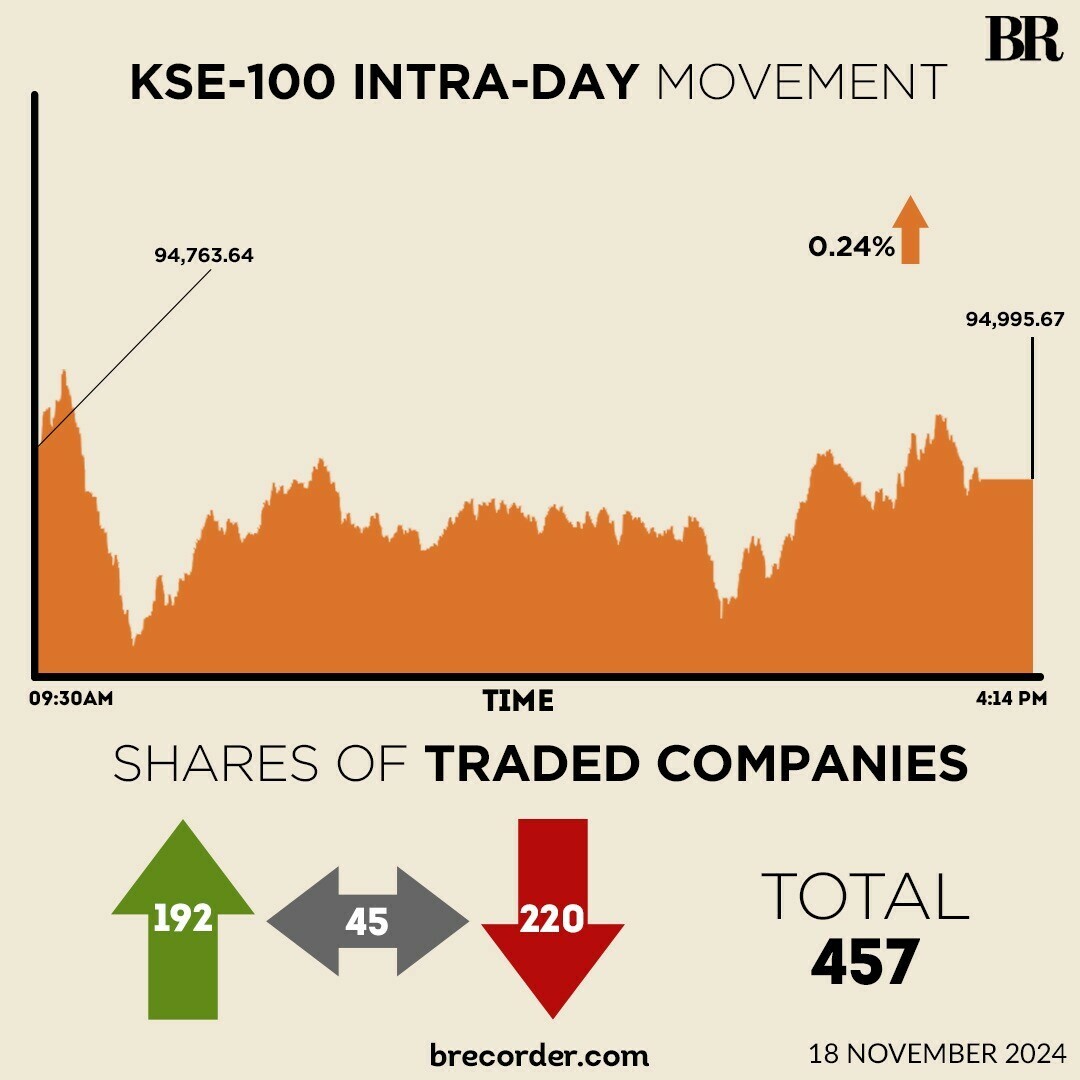

The KSE-100 started the session positive, hitting an intra-day high of 95,307.92, which was followed by a brief selling spree that pushed the index to an intra-day low of 94,620.45.

However, the latter part of the day witnessed a bull-run that aided the index to close shy of 95,000.

At close, the benchmark index settled at 94,995.67, up by 232.03 points 0.24%.

Investor confidence was lifted on Monday by the recent International Monetary Fund (IMF) statement, brokerage house Topline Securities said in its post-market report.

Key contributors to the index’s upward movement included FFC, HBL, PSEL, SNGP, and LUCK, collectively adding 328 points. On the other hand, UBL, EFERT, and HUBC faced profit-taking, collectively dragging the index down by 164 points, the report said.

The IMF delegation that concluded its Pakistan’s visit on November 15 “had constructive discussions with the authorities on their economic policy and reform efforts to reduce vulnerabilities and lay the basis for stronger and sustainable growth,” said Nathan Porter, IMF mission chief, in a statement released by the Washington-based lender on Friday.

On Friday, the KSE-100 gained 572 points to close at then record high of 94,763.64.

In a key development, Pakistan’s current account posted a surplus of $349 million in October 2024 compared to a deficit of $287 million in the same month of the previous year, data released on Monday by the State Bank of Pakistan (SBP) showed.

The Net Foreign Direct Investment (FDI) in Pakistan grew 32.3% during the first four months of the ongoing fiscal year (FY25), clocking in at $904.3 million, central bank data revealed.

During July-October FY25, FDI inflows were $1,242.5 million against an outflow of $338.2 million, according to the SBP.

Pakistan’s Real Effective Exchange Rate (REER), a measure of the value of a currency against a weighted average of several foreign currencies, witnessed an increase as it clocked in at 100.86 in October 2024, up from 98.64 (revised) in September 2024, SBP data showed.

European and Asian stock markets traded mixed on Monday following a pre-weekend retreat on Wall Street as investors scaled back bets on US interest-rate cuts, fearing Donald Trump’s policies could reignite inflation.

Global equity markets have cooled since Trump’s US election win this month, while investor attention has turned to his upcoming pick for Treasury secretary.

All three main indices on Wall Street ended deep in the red Friday, with the Nasdaq down more than 2%, after Federal Reserve boss Jerome Powell signalled a slower pace of interest rate cuts.

Meanwhile, the Pakistani rupee recorded marginal decline against the US dollar, depreciating 0.07% in the inter-bank market on Monday. At close, the currency settled at 277.86, a loss of Re0.19 against the greenback.

Expectations that a second Trump administration will impose painful fresh tariffs on Chinese goods has added to the unease and ramped up fears of another trade war between the economic powerhouses.

Volume on the all-share index decreased to 765.21 million from 893.17 million on Friday.

The value of shares declined to Rs23.92 billion from Rs30.81 billion in the previous session.

Hascol Petrol was the volume leader with 85.14 million shares, followed by Fauji Foods Ltd with 60.50 million shares, and K-Electric Ltd with 58.38 million shares.

Shares of 457 companies were traded on Monday, of which 192 registered an increase, 220 recorded a fall, while 45 remained unchanged.

Read the full story at the Business Recorder - Latest News website.