Pakistan Stock Exchange’s (PSX) benchmark index KSE-100 closed slightly lower on Tuesday after witnessing a directionless session amid lack of positive triggers.

The KSE-100 remained range-bound since start of the session, managing to hit an intra-day high of 47,675.22. However, profit-taking erased the gains.

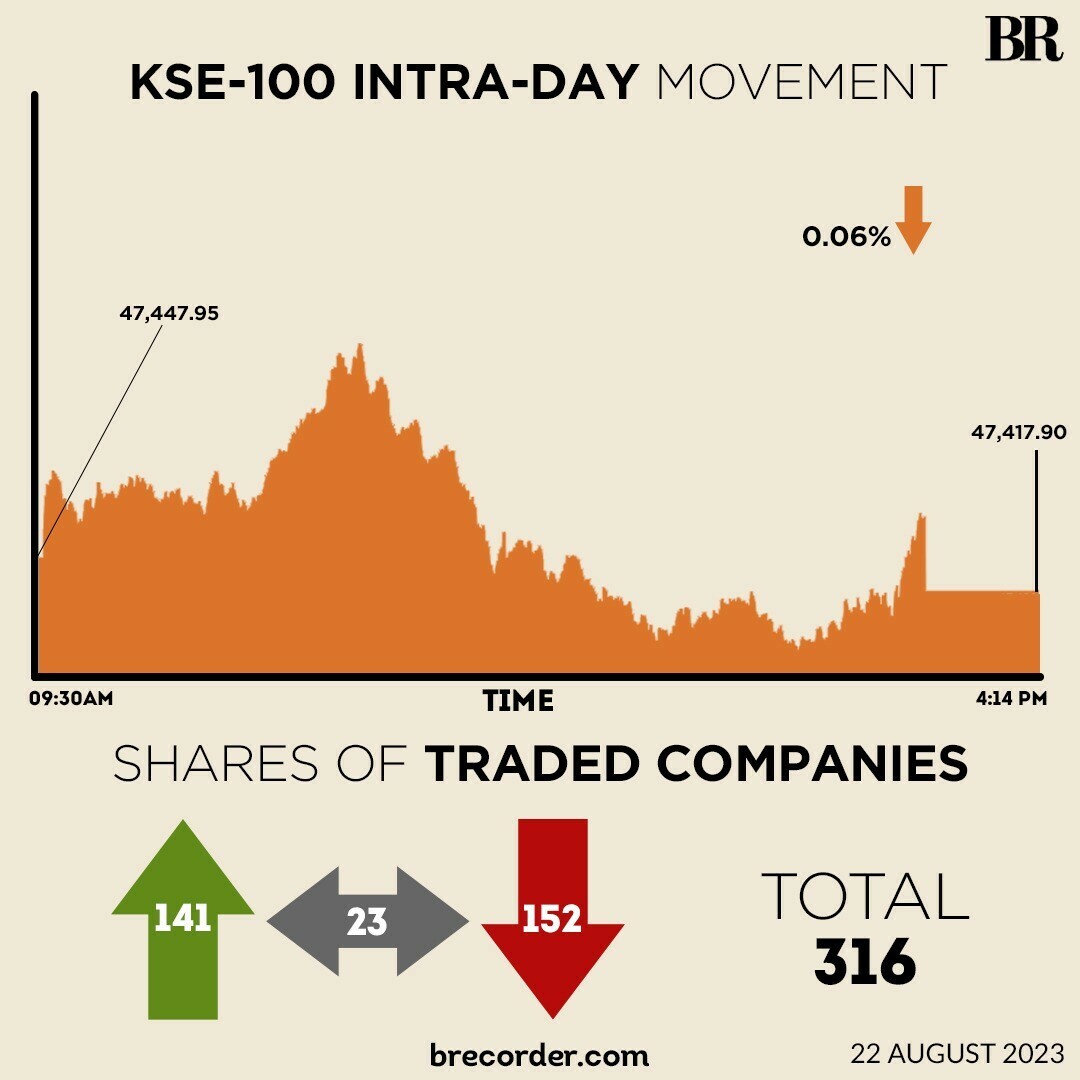

At close, the benchmark index settled at 47,417.90, down by 30.06 points or 0.06%.

“The equity market remained range-bound today [Tuesday] amid dearth of positive triggers,” brokerage house Topline Securities said in its market report.

However, it added, energy chain remained in the limelight on the back of hopes of circular debt settlement.

During the trading hours banks, E&P, and OMC sector stocks gained momentum as OGDC, MARI, PPL, PSO & BAFL cumulatively added 121 points, On the flip side BAHL, HUBC, and DAWH collectively lost value to weigh down on the index by -56 points, brokerage house Topline Securities said.

On Monday, the KSE-100 had fallen by 770.54 points as negativity persisted at the PSX.

On the economic front, the Pakistani rupee fell to a new record low against the US dollar, depreciating 0.63% in the inter-bank market on Tuesday. At close, the rupee settled at 299.01, a decrease of Rs1.88, as per the State Bank of Pakistan.

Power generation in Pakistan clocked in at 14,839 GWh (19,945MW) in July 2023, up 4.9% as compared to the same period last year. Back in July 2022, power generation had stood at 14,151 GWh (19,020MW).

Volume on the all-share index decreased to 185.75 million from 211.23 million on Monday.

The value of shares declined to Rs6.22 billion from Rs7.07 billion in the previous session.

WorldCall Telecom remained the volume leader with 25.87 million shares, followed by Nishat Power with 16.05 million shares and Oil & Gas Development Company Limited with 13.63 million shares.

Shares of 316 companies were traded on Tuesday, of which 141 registered an increase, 152 recorded a fall, and 23 remained unchanged.

Read the full story at the Business Recorder - Latest News website.