The Pakistan Stock Exchange (PSX) witnessed choppy trading on Wednesday, allowing the index to close with a marginal gain of 131 points.

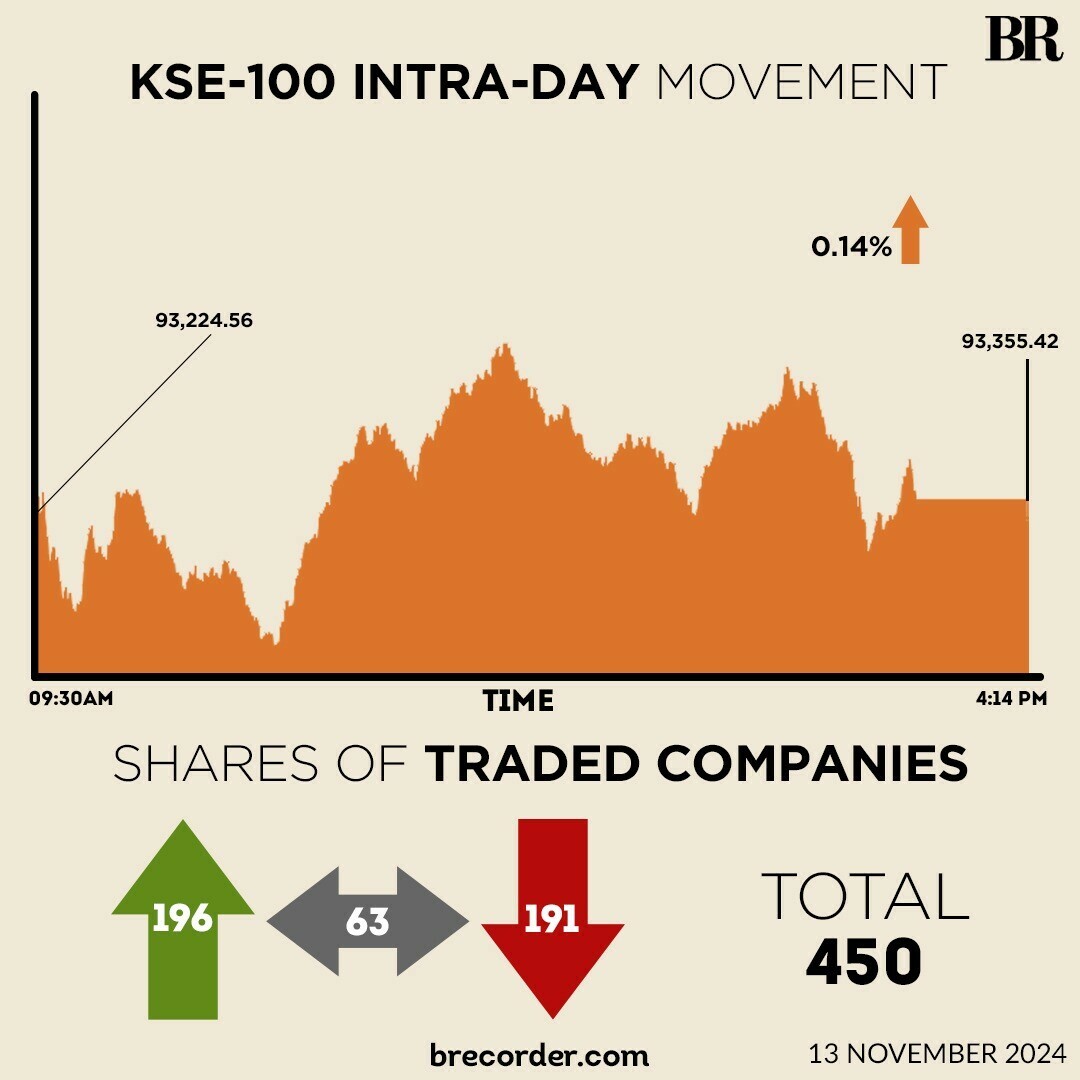

The KSE-100 started the session negative, hitting an intra-day low of 92,943.08.

A buying spree later pushed the index to an intra-day high of 93,803.59, followed by some selling that trimmed the gains.

At close, the benchmark index settled at 93,355.43, up by 130.86 points or 0.14%.

“The market exhibited a consolidation phase, with the index reaching a peak of 93,804 and dipping to a low of 92,943. Notable, consistent buying by local mutual funds supported the market in the recent rally,” brokerage house Topline Securities said.

The index was boosted by positive contributions from MARI, LUCK, SEARL, ENGRO, and POL, which collectively added 461 points. Conversely, OGDC, FFC, and MEBL experienced some profit-taking, resulting in a combined loss of 213 points to the index, it added.

On Tuesday, after days of positive momentum, profit-taking was witnessed as the KSE-100 closed lower by 424 points.

In a key development, Rousch (Pakistan) Power Limited (RPPL), an Independent Power Producer (IPP), approved early termination of its long-term agreements with the government and authorised its management to execute a negotiated settlement agreement.

The development was shared by Altern Energy Limited, the parent company of RPPL, in a notice to the PSX on Wednesday.

CCL Holding (Private) Limited, a subsidiary of CCL Pharmaceuticals, submitted a public announcement of intention (PAI) to acquire a 50% stake and controlling interest in Mitchells Fruit Farms Ltd (MFFL).

Arif Habib Limited, appointed Manager to the Offer by CCL Holding (Private) Limited, shared the development in its bourse notice.

Oil and Gas Development Company Limited (OGDCL), the country’s largest exploration and production (E&P) company, said it had initiated the production of natural gas from the Uch-35 development well, located in Dera Bugti district, Balochistan.

Globally, Asian stocks slumped on Wednesday as a sharp rise in US bond yields unnerved investors ahead of key inflation data that could inform the pace of Federal Reserve policy easing.

Short-term Treasury yields jumped to the highest since late July overnight as the market reopened after the Veterans Day holiday, spurring the US dollar to a more than three-month peak versus the yen in the latest session.

Bond yields have soared since Donald Trump was elected back to the White House last week on expectations lower taxes and higher tariffs will push up the fiscal deficit and increase government borrowing.

Hong Kong’s Hang Seng slid 0.9% as of 0147 GMT, with a subindex of mainland Chinese property stocks slumping 1.3%. China’s blue chips were flat.

Japan’s Nikkei and South Korea’s Kospi sagged 1.1% and 1.2%, respectively, while Australia’s stock benchmark fell 1.1% under the weight of commodity shares.

US S&P 500 futures also pointed about 0.1% lower following a 0.3% decline overnight.

The two-year Treasury yield stood at 4.34% after leaping to 4.367% on Tuesday for the first time since July 31.

The 10-year yield hovered around 4.43%, not far from the four-month high of 4.479% reached a week ago in the immediate aftermath of Trump’s sweeping victory.

The dollar edged up to as high as 154.94 yen for the first time since July 30 before last changing hands at 154.56 yen.

Meanwhile, the Pakistani rupee registered marginal improvement against the US dollar, appreciating 0.03% in the inter-bank market on Wednesday. At close, the currency settled at 277.85, a gain of Re0.08 against the greenback.

Volume on the all-share index increased to 807.07 million from 792.90 million on Tuesday.

The value of shares rose to Rs31.69 billion from Rs30.79 billion in the previous session.

WorldCall Telecom was the volume leader with 43.29 million shares, followed by Waves Home App with 33.20 million shares, and Pak Refinery with 31.52 million shares.

Shares of 450 companies were traded on Wednesday, of which 196 registered an increase, 191 recorded a fall, while 63 remained unchanged.

Read the full story at the Business Recorder - Latest News website.