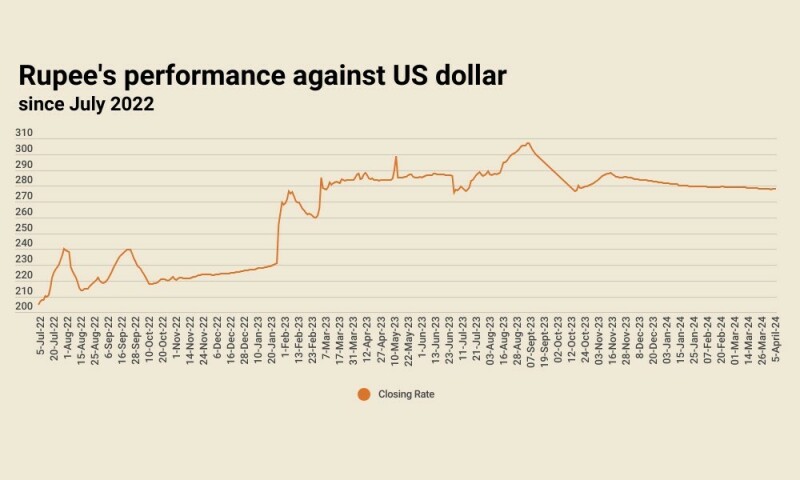

The Pakistani rupee remained unchanged against the US dollar in the inter-bank market on Friday.

At close, the local unit settled at 277.93 against the greenback, as per the State Bank of Pakistan (SBP).

On Thursday, the rupee remained largely stable to settle at 277.93 against the US dollar, according to the SBP.

In a key development, the International Monetary Fund (IMF) said that its Executive Board meeting is expected to be held in “late April” upon which Pakistan would receive funds of around $1.1 billion.

Meanwhile, Prime Minister Shehbaz Sharif highlighted the importance of a new IMF programme for the revival of the economy.

Finance minister Muhammad Aurangzeb is leaving for Washington to attend the World Bank and the IMF spring meetings where he would also hold talks on a new programme.

Internationally, the US dollar held steady against peer currencies on Friday after rebounding from a two-week low, as traders braced for a key jobs report due later in the day and grew cautious over tensions in the Middle East.

Overall, however, major currencies were looking rather subdued on Friday before the March nonfarm payrolls report.

The dollar has had a turbulent week, falling from a five-month high to a two-week low after an unexpected slowdown in US services growth supported expectations of bringing interest rates down.

The jobs data, as well as incoming inflation readings next week, will be important in shaping the outlook for the Fed’s April 30-May 1 and June 11-12 policy meetings. Economists expect 200,000 jobs were added in March.

Oil prices, a key indicator of currency parity, extended gains on Friday and headed for a second weekly gain, supported by geopolitical tensions in Europe and the Middle East, concerns over tightening supply, and optimism about global fuel demand growth as economies improve.

Brent crude climbed 59 cents, or 0.7%, to $91.24 a barrel by 0646 GMT.

US West Texas Intermediate crude was at $87.02 a barrel, up 43 cents, or 0.5%.

Both benchmarks settled at their highest since October on Thursday.

Read the full story at the Business Recorder - Latest News website.