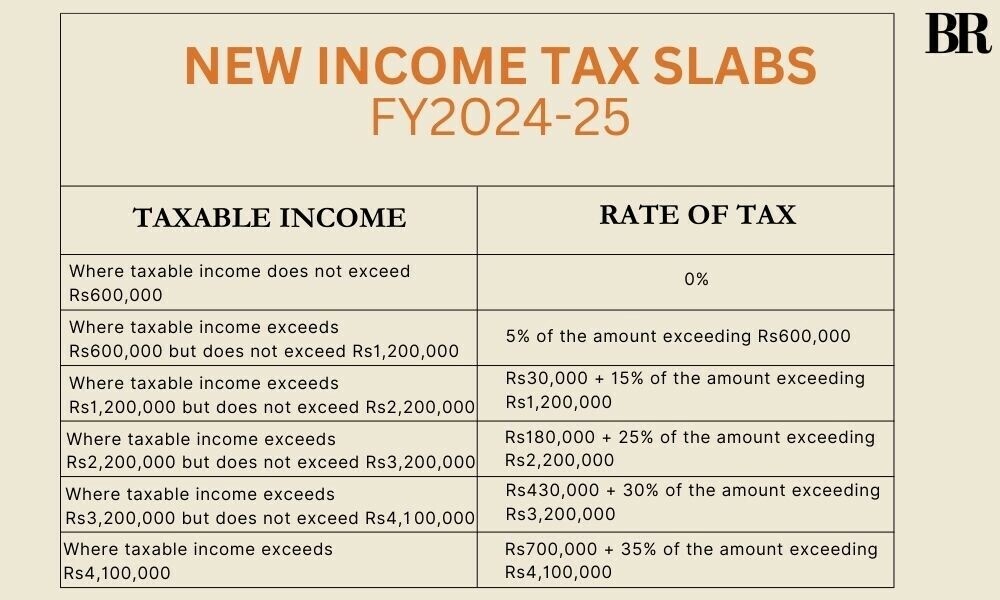

The fear of Pakistan’s salaried group became reality on Wednesday as the government increased tax liability for all persons earning more than Rs50,000 a month in Budget 2024-25.

Tax slabs in Finance Bill 2024 reveal that the highest impact would be on anyone earning equal to or more than Rs6 million a year (Rs500,000 a month). The tax liability for these earners increases by Rs22,500.

Interestingly, the tax increase for salaried persons earning as high as Rs12 million a year (Rs1 million a month) is also Rs22,500.

While the government did not touch the income tax exemption threshold – which still stands at Rs50,000 – liability has increased across all other levels of salaries. For example, a person earning Rs100,000 a month will now pay Rs2,500 a month, up from the earlier level of Rs1,250.

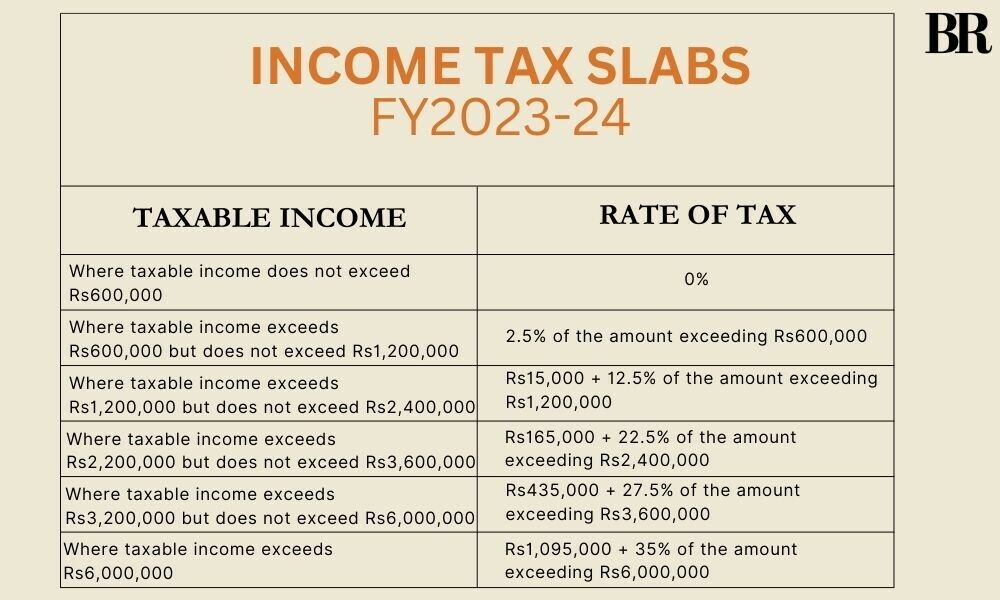

The government had also imposed a higher income tax on salaried persons last year on what it saw as ‘high earners’.

PERSPECTIVES: Pakistan’s salaried group is rightly anxious ahead of the budget

Finance Minister Muhammad Aurangzeb, during his budget speech, said the government did not change the number of slabs. While the number of slabs did not in fact change, the composition within them changed drastically.

In an article written by this correspondent two days ago, it was stated that during the outgoing fiscal year, the salaried group has contributed around Rs330 billion in 11 months.

“This amount is projected to stand at Rs360 billion over the entire fiscal year, a phenomenal 36% increase during a year when inflation stood at an average of 24.5% in 11 months of the outgoing fiscal year,” it was written in the article.

Income tax calculator for FY 2024-25

Read the full story at the Business Recorder - Latest News website.