Pakistan’s economy contracted due to lingering impacts of 2022’s devastating floods, uncertainty, and policy slippage in fiscal year 2023 (FY2023, ended 30 June 2023), weakened production, consumption, and investment, the Asian Development Bank (ADB) said in a new report today.

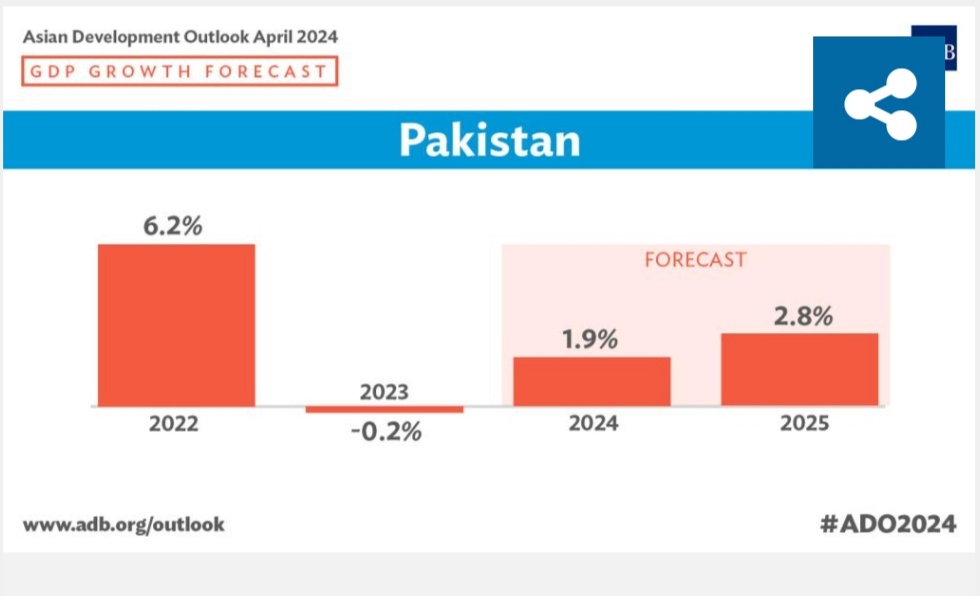

According to the Asian Development Outlook (ADO) April 2024, ADB’s annual flagship economic publication, Pakistan’s gross domestic product (GDP) growth is projected to recover modestly to 1.9% in FY2024 from -0.2% in FY2023 as economic reforms take effect and inflationary pressures ease.

Adhering to the economic adjustment program is critical to restoring macroeconomic stability and the gradual recovery of growth.

Downside risks to the outlook remain high. “Pakistan’s economy is showing signs of a gradual recovery supported by higher crop output and improvement in manufacturing,” said ADB Country Director for Pakistan Yong Ye. “Growth is forecast to resume in 2024 and strengthen in 2025—but the continued implementation of policy reforms is crucial to buttressing this momentum and fortifying the country’s fiscal and external buffers.”In FY2024, growth will be supported by a rebound in private sector investment linked to progress on reform measures.

In FY2025, growth is projected to reach 2.8%, driven by higher confidence, reduced macroeconomic imbalances, greater political stability, and improved external conditions. Headline inflation jumped to 29.2% in FY2023, a 5-decade high, due to higher food prices resulting from flood-induced supply disruptions and import controls, increases to administered energy prices, and currency depreciation.

Inflation will remain high—at about 25% in FY2024, driven by higher energy prices, but is expected to ease to 15% in FY2025 as inflation expectations moderate and progress on macroeconomic stabilization restores confidence.

The central bank has maintained a tightened monetary policy, keeping the policy interest rate at 22% in response to persistent inflationary pressures and external imbalances.

The central bank has committed to an appropriately tight policy to lower inflation to its medium-term target range of 5%–7%.