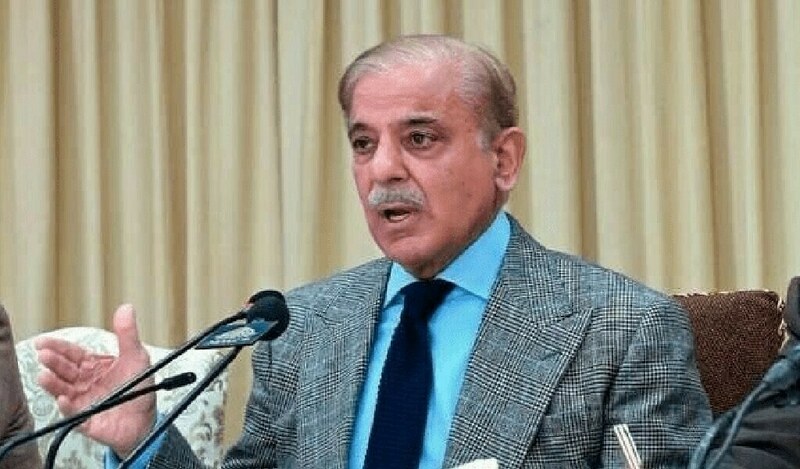

ISLAMABAD: Prime Minister Shehbaz Sharif has directed the Federal Board of Revenue (FBR) to expedite efforts for detection of tax fraud cases and ensure recovery in mega sales tax scams.

Sources told Business Recorder that the prime minister has shown special interest in speedy recovery from big tax fraud cases. The government wanted to plug loopholes in the system to detect tax fraud cases. Under the enforcement/administrative measures of over Rs 200 billion in 2024-25, one of the key areas is the check tax frauds in major areas/sectors of the economy.

The estimated sales tax amount evaded through the fraudulent use of flying invoices (irrelevant invoices) would be approximately Rs 5-6 trillion.

Sales tax fraud and fake invoices: Aurangzeb directs FBR to detect cases

The FBR’s investigating agencies are arresting inter province gangs of fake /flying sales tax invoice mafias involved in such scams causing huge revenue loss to national exchequer.

On the directions of the prime minister, the FBR has decided to establish a Tax Fraud Investigation Wing-Inland Revenue to detect, analyse, investigate, combat and prevent tax fraud.

Under the plan, there shall be established a wing to be known as Tax Fraud Investigation Wing-Inland Revenue. The tax fraud Investigation Wing-Inland Revenue shall comprise Fraud Intelligence and Analysis Unit, Fraud Investigation Unit, Legal Unit, Accountants Unit, Digital Forensic and Scene of Crime Unit, Administrative Unit or any other Unit as may be notified by the Board through notification in the official Gazette.

The Tax Fraud Investigation Wing-Inland Revenue shall consist of a Chief Investigator and as many following officers, as may be notified by the Board: (a) Senior investigators, investigators, Junior investigators or any other officer of Inland Revenue with any other designation; (b) a Senior Forensic Analyst and as many Forensic Analysts and Junior Forensic Analysts; and (c) a Senior Data Analyst and as many Data Analysts and Junior Data Analysts.

Copyright Business Recorder, 2024

Read the full story at the Business Recorder - Latest News website.