Redco Textiles Limited (PSX: REDCO) is incorporated in Pakistan as a public limited company. It began its operations in 1991 and is engaged in the manufacturing and sale of yarn and greige fabric.

Pattern of Shareholding

As of June 30, 2024, REDCO has a total of 49.293 million shares outstanding which are held by 760 shareholders. Directors, CEO, their spouses, and minor children are the major shareholders of REDCO holding 60.52 percent shares followed by the local general public holding 30.61 percent shares. Insurance companies have a stake of 3.99 percent in the company while banks, DFIs, and NBFIs have a representation of 2 percent in the outstanding share capital of REDCO. About 1.31 percent of the company’s shares are held by investment companies. The remaining shares are held by other categories of shareholders.

Historical Performance (2019-24)

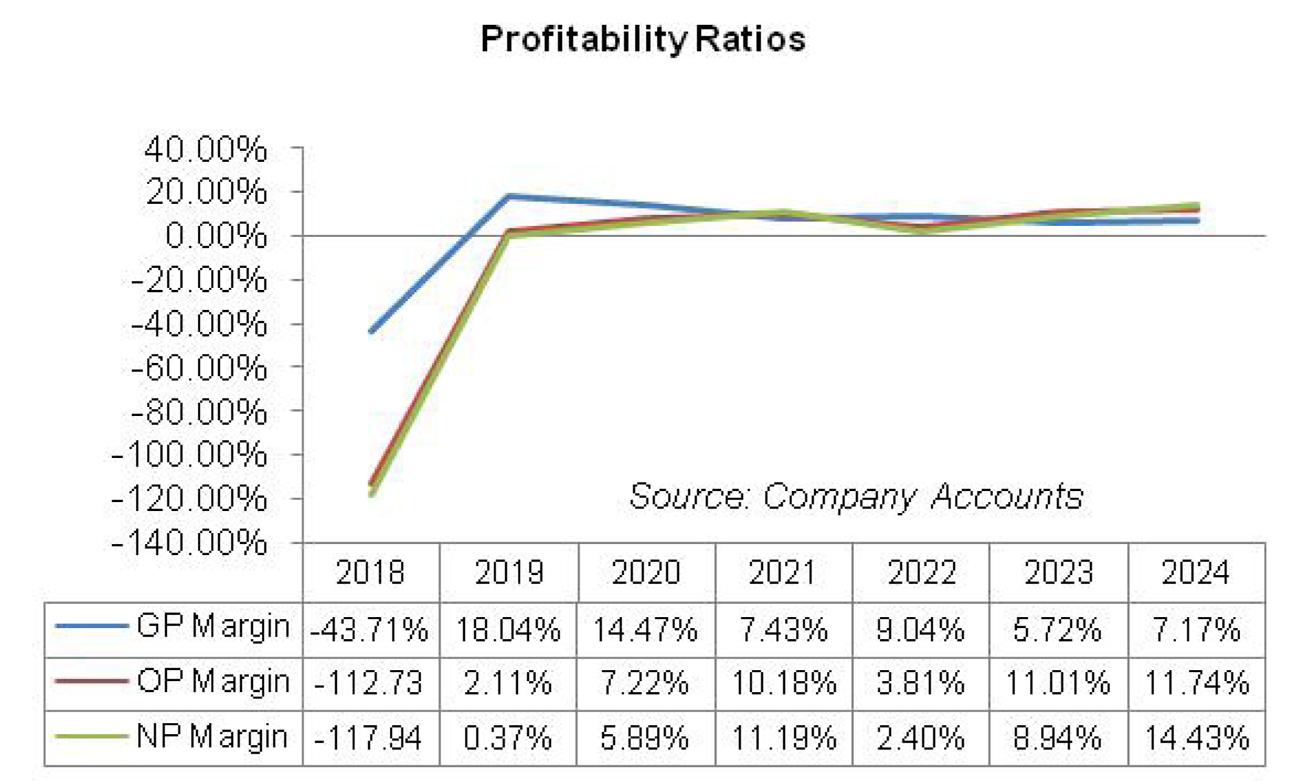

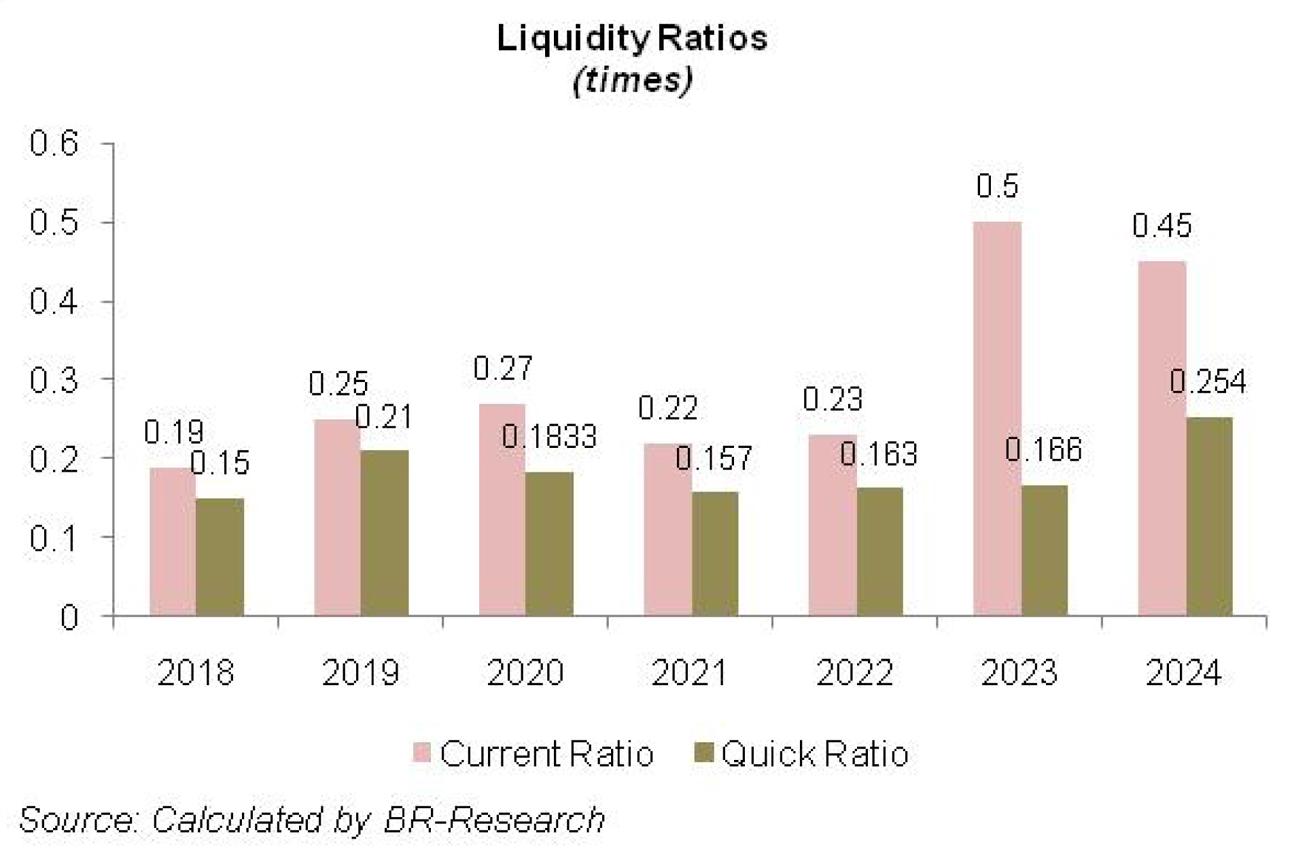

Except for a year-on-year decline in 2019, REDCO’s topline has been registering year-on-year growth over the period under consideration. Conversely, its bottom line slid in 2022. The gross margin of the company after posting a recovery in 2019 followed a downhill journey until 2021. It then rebounded in 2022. In 2023, gross margin dipped followed by an uptick in 2024. Conversely, operating margin and net profit margins followed an upward trajectory until 2021 followed by a drastic decline in 2022. In the subsequent years, both operating and net margins grew to attain their optimum level in 2024. The detailed performance review of the period under consideration is given below.

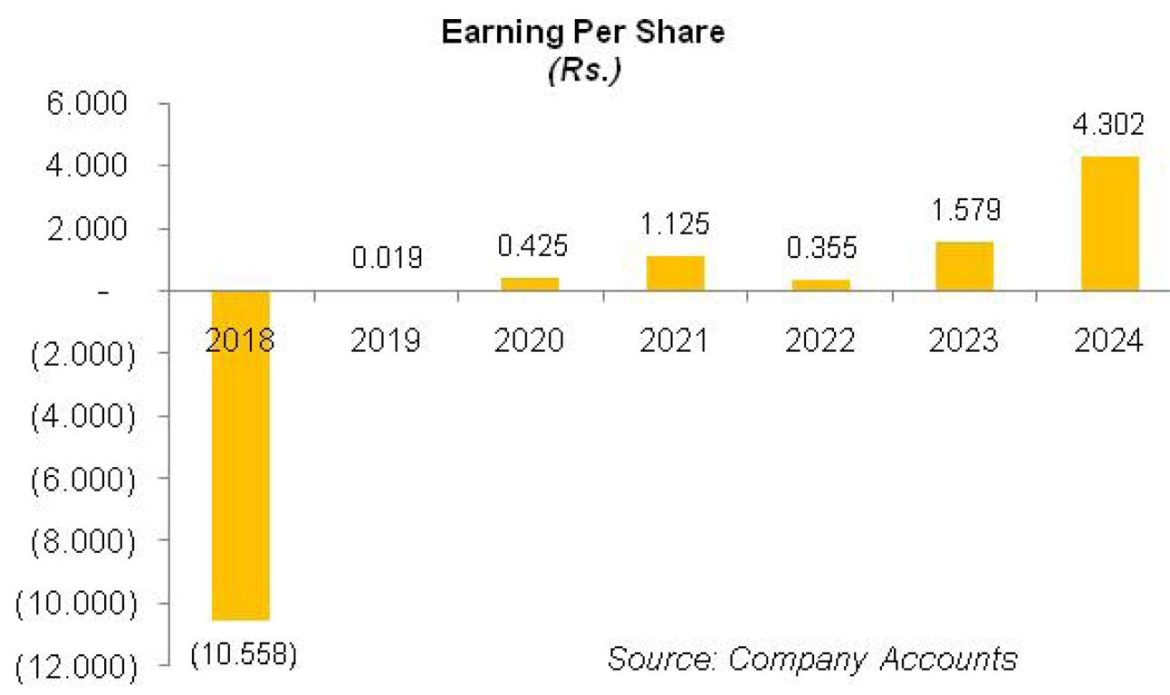

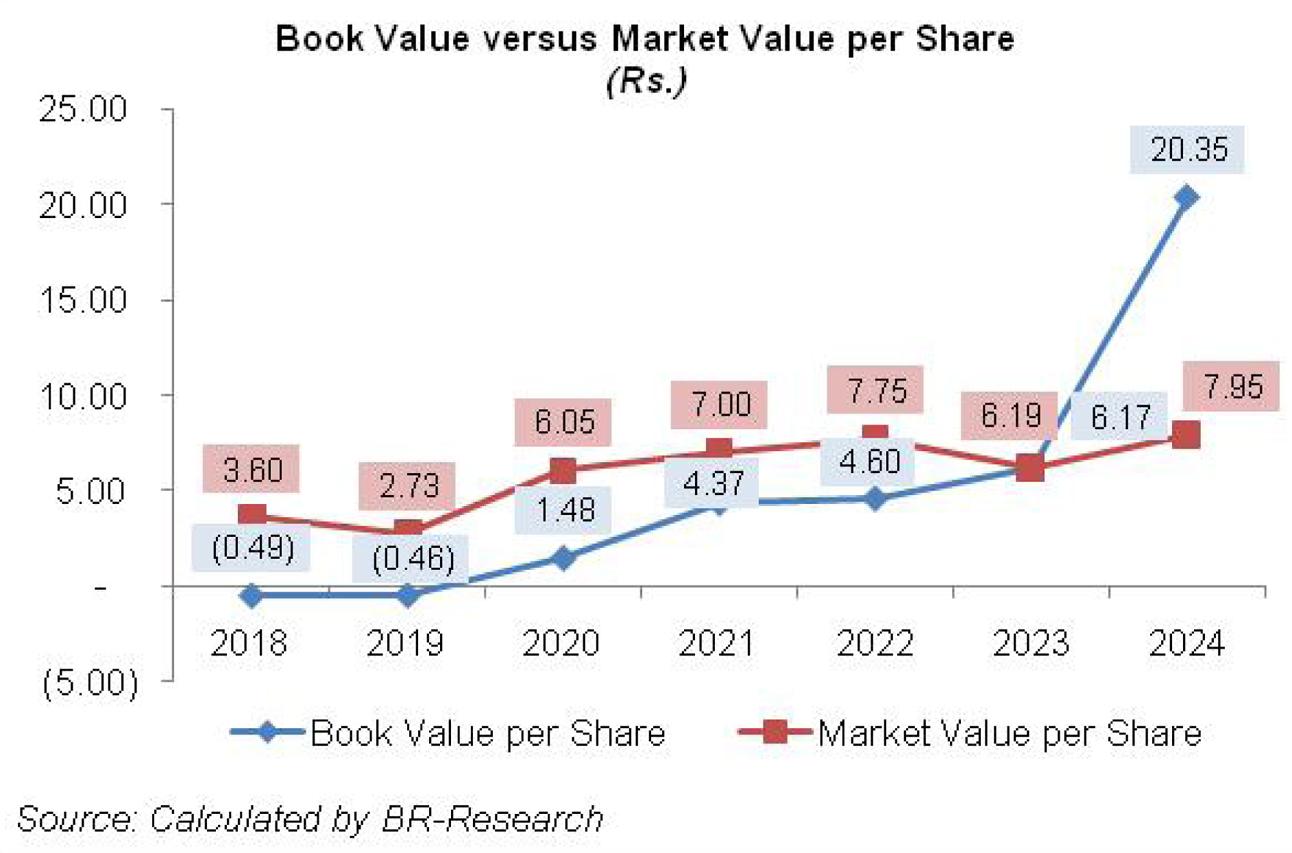

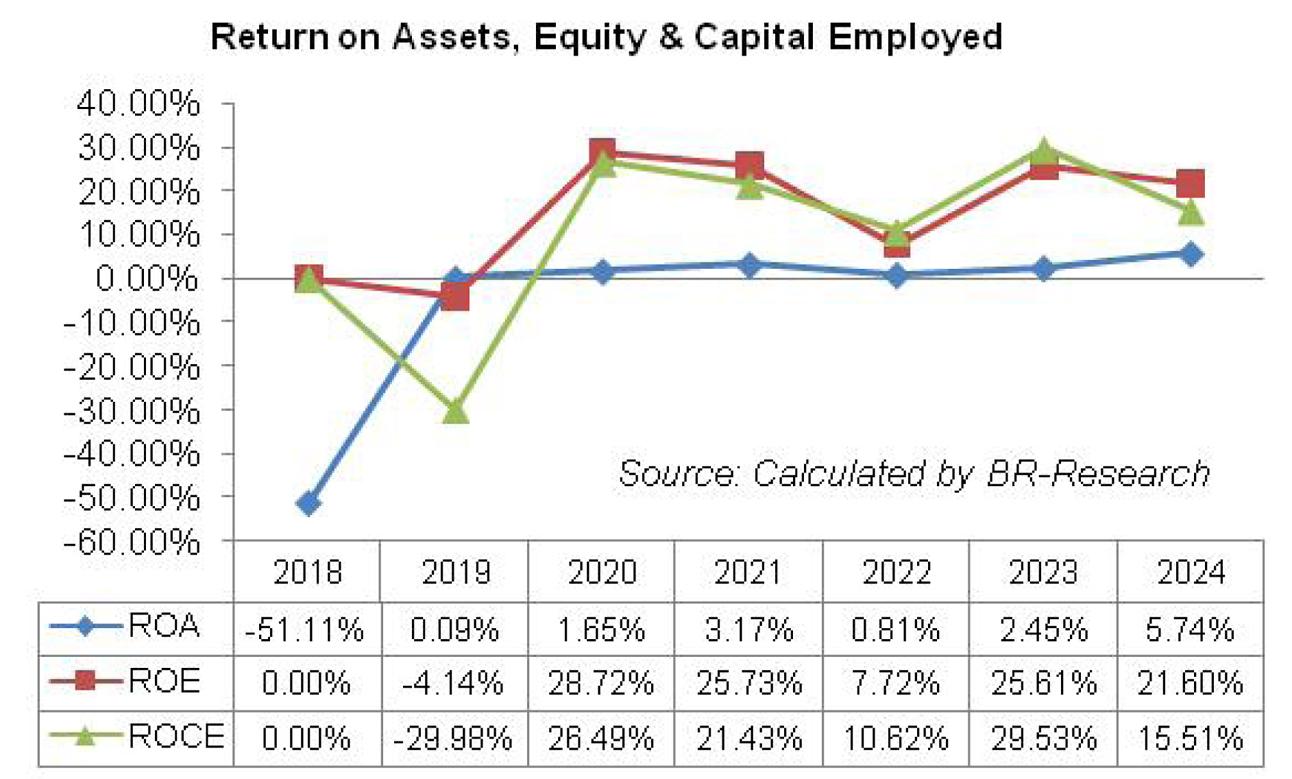

In 2019, REDCO’s net sales dipped by 43 percent year-on-year. During the year, the company had suspended its operations due to the high cost of doing business, incidental taxes, provincial cess, and withholding tax which had rendered the local textile industry uncompetitive compared to their international counterparts. However, it resumed its operations in December 2018 after the government announced a subsidy for the textile industry by reducing RLNG rates. Moreover, during the period of shutdown, the company installed 20 looms to increase its productivity and reduce conversion costs. Due to less number of operational days, the sales of both yarn and fabric tumbled; however, the company was able to post a gross profit of Rs.45.34 million in 2019 as against the gross loss of Rs.192.86 million recorded in 2018. GP margin stood at 18 percent in 2019. The company was able to trim down its distribution cost by 93.28 percent year-on-year in 2019 mainly on account of low payroll expenses as well as low carriage, freight, and taxes. Administrative expenses also slumped by 6.17 percent year-on-year in 2019. Other expenses which stood at a whopping Rs.285 million in 2018 due to impairment loss on fixed assets as well as loss on disposal of fixed assets shrank to Rs.25.77 million in 2019. REDCO posted an operating profit of Rs.5.305 million in 2019 with an OP margin of 2.1 percent. Finance costs inched down by 76.47 percent year-on-year in 2019 despite a high discount rate during the year. This was because the company largely settled the loans obtained from banking companies. As of June 30, 2019, REDCO’s balance sheet only contained interest-free loans from associated undertakings and company directors. The company posted a net profit of Rs.0.94 million in 2019 as against a net loss of Rs.520.43 million posted in 2018. EPS stood at Rs.0.019 in 2019 versus a loss per share of Rs.10.558 registered in 2018.

In 2020, REDCO’s topline grew by 41.42 percent year-on-year despite the outspread of COVID-19. In the first three quarters of 2020, sales volume posted impressive growth mainly due to the installation of 32 air jet looms and also because of the replacement of sizing and warping with the latest model machines. The topline also included export sales of Rs.11.083 million which wasn’t there until 2019. The cost of sales grew by 47.57 percent year-on-year in 2020 due to an increase in utility charges and also because of the Pak Rupee depreciation. Gross profit grew by 13.44 percent year-on-year in 2020, however, GP margin climbed down to 14.5 percent. Distribution expenses nosedived by 12.7 percent year-on-year in 2020 while administrative expenses rose by 20.89 percent year-on-year in 2020. Other expenses fell by 66.27 percent year-on-year in 2020 on account of lesser loss on the disposal of fixed assets and lesser allowance booked for expected credit loss on trade debts. Operating profit grew by a massive 384 percent year-on-year in 2020 while OP margin mounted to 7.2 percent. Finance costs shrank by 90.91 percent year-on-year in 2020 as there were no short-term borrowings from banking institutions as of June 2020. However, the company borrowed Rs.12.049 million under the SBP Refinance Scheme for the payment of salaries and wages at a mark-up rate of 3 percent per annum. The bottom line expanded by 2124.26 percent year-on-year in 2020 to clock in at Rs.20.95 million with an NP margin of 5.9 percent. EPS surged to Rs.0.425 in 2020

2021 posted a topline growth of 39.38 percent year-on-year. During the year, the company installed another 40 air jet looms to increase its productivity. While there were no export sales in 2021, local sales of both yarn and fabric posted a staggering growth. The cost of sales increased because of high inflation, high utility charges as well as Pak Rupee depreciation. Consequently, gross profit dropped by 28.45 percent year-on-year in 2021 with GP margin falling down to 7.4 percent. Lesser local taxes, carriage, and freight resulted in a 28.51 percent year-on-year drop in distribution expenses while administrative expenses grew by 2.1 percent year-on-year on the back of high payroll expenses in 2021. Other expenses dwindled by 20.86 percent year-on-year in 2021 due to lesser WPPF and no loss on the disposal of fixed assets in 2021. Other income multiplied by over 52026.72 percent to clock in at Rs.37.94 million in 2021. This was on account of the previous year’s impairment coupled with the amortization of the government grant. Operating profit grew by 96.5 percent year-on-year in 2021 translating into an OP margin of 10.2 percent. Finance cost grew by over 1525 percent to clock in at Rs.2.06 million due to higher bank charges, high markup on WPPF, and long-term borrowings. The bottom line grew by 164.59 percent year-on-year in 2021 to clock in at Rs.55.44 million with an NP margin of 11.2 percent. EPS rose to Rs.1.125 in 2021.

In 2022, REDCO witnessed topline growth of 47 percent year-on-year. The company increased its production capacity by adding 36 air jet looms in 2022. While the sale of yarn significantly dropped during the year, the sale of fabric posted an encouraging growth. Due to a shortage of gas, the company had to rely on electrical energy which increased the cost of sales by 44.49 percent year-on-year in 2022. However, as the sales mix majorly included fabric which had better pricing, GP margin mounted to 9 percent in 2022. Distribution and administrative expenses inched up by 150.12 percent and 32.54 percent respectively in 2022 mainly on account of higher payroll expenses. Higher loss on disposal of fixed assets resulted in a 126.44 percent year-on-year rise in other expenses in 2022. Consequently, operating profit declined by 45 percent year-on-year in 2022 with OP margin shrinking to 3.8 percent. Finance cost shriveled by 58.85 percent year-on-year in 2022 due to a massive drop in the company’s long-term financing as well as bank charges during the year coupled with lesser WPPF. The bottom line tapered off by 68.45 percent year-on-year in 2022 to clock in at Rs.17.49 million with an NP margin of 2.4 percent. EPS dropped to Rs.0.355 in 2022.

During 2023, REDCO’s topline grew by 19.54 percent year-on-year. While the company made no yarn sales in 2023, the growth was driven by the sale of fabric. The company installed 20 new Toyota air jet looms during the year as a part of its periodic plant renewal strategy. This greatly improved the company’s production capacity and efficiency in 2023. However, the high cost of sales due to mounting energy charges, high inflation, and supply chain impediments due to massive floods that destroyed the crop, resulted in a 24.4 percent drop in gross profit in 2023 with the GP margin plummeting to 5.7 percent. Distribution cost multiplied by 7.44 percent year-on-year in 2023 on account of higher salaries paid in the distribution network. Administrative costs also inched up by 9.78 percent year-on-year in 2023 due to inflationary pressure which drove the payroll expense. The company downsized its workforce from 699 employees in 2022 to 549 employees in 2023. Other expenses slid by 37.21 percent year-on-year in 2023 due to no loss recorded on the disposal of fixed assets in 2023. REDCO also didn’t record the unwinding of salary loans in 2023. Other income grew by 10084 percent year-on-year to clock in at Rs.81.49 million in 2024 due to liability written off during the year. Hefty other income allowed the company to record an operating profit of Rs.95.90 million in 2023, up 245.54 percent year-on-year. Finance cost mounted by 111 percent in 2023 to clock in at Rs.1.79 million. This was due to an unprecedented level of discount rate which increased the mark-up incurred on WPPF. Bank charges & commissions also greatly increased during the year. Net profit strengthened by 345.10 percent to clock in at Rs.77.845 million in 2023 with EPS of Rs.1.579 and NP margin of 8.9 percent.

In 2024, REDCO’s topline posted a phenomenal year-on-year rise of 66.8 percent driven by the sale of fabric. Inflationary pressure coupled with elevated prices of energy and other inputs drove the cost of sales up by 66.19 percent in 2024. Gross profit improved by 111.85 percent in 2024 with GP margin climbing up to 7.2 percent. During the year, the company’s distribution expense spiked by 333.48 percent due to a massive increase in salaries & benefits of the workforce pertaining to the distribution network. Conversely, administrative expenses slid by 3.18 percent in 2024 due to lower depreciation expenses incurred during the year. Other expenses mounted by 83 percent in 2024 due to higher provisions booked for WPPF, doubtful debts & advances, and ECL on trade debts. Other income strengthened by 36.96 percent in 2024 on account of gain recognized on the sale of assets. REDCO recorded a 79.96 percent improvement in its operating profit in 2024 with OP margin rising up to 11.7 percent. Finance costs increased by 49.39 percent in 2024 to clock in at Rs.2.68 million. This was on account of higher bank charges & commissions and higher mark-up incurred on WPPF. REDCO recorded 172.44 percent year-on-year growth in its net profit in 2024 which clocked in at Rs.212.08 million with EPS of Rs.4.302. NP margin attained its highest level of 14.4 percent in 2024.

Recent Performance (1QFY25)

In 1QFY25, REDCO recorded a staggering rise of 107.364 percent in its topline. This was on account of improved sales volume and prices. The company has started shifting towards alternate energy sources by installing solar panels. This resulted in immense cost savings for the company. Resultantly, gross profit mounted by 756.244 percent in 1QFY25 to clock in at Rs.76.18 million. This translated into a GP margin of 17.1 percent in 1QFY25 versus a GP margin of 4.1 percent recorded during the same period last year. Distribution expense multiplied by 287.6 percent in 1QFY25 due to higher salaries expense of the workforce pertaining to the distribution network. Conversely, administrative expenses inched down by 3.913 percent during the period probably due to lower depreciation expenses. Other expenses inched by a paltry 0.597 percent in 1QFY25. Conversely, other income dipped by 93 percent during the period due to the high-base effect as the company recognized a gain on the sale of assets during the last year. High other income recorded during 1QFY24 had pushed up the company’s operating profit and resulted in an OP margin of 45.5 percent. The lack of the same during the current period resulted in 24.12 percent thinner operating profit in 1QFY25 with OP margin falling down to 16.7 percent. Finance cost grew by 38.81 percent in 1QFY25, however, it largely comprised bank charges. Net profit inched up by 6.73 percent in 1QFY25 to clock in at Rs.86.46 million with EPS of Rs.1.754 versus EPS of Rs.1.64 recorded during the same period last year. NP margin also fell from 37.7 percent in 1QFY24 to 19.4 percent in 1QFY25.

Future Outlook

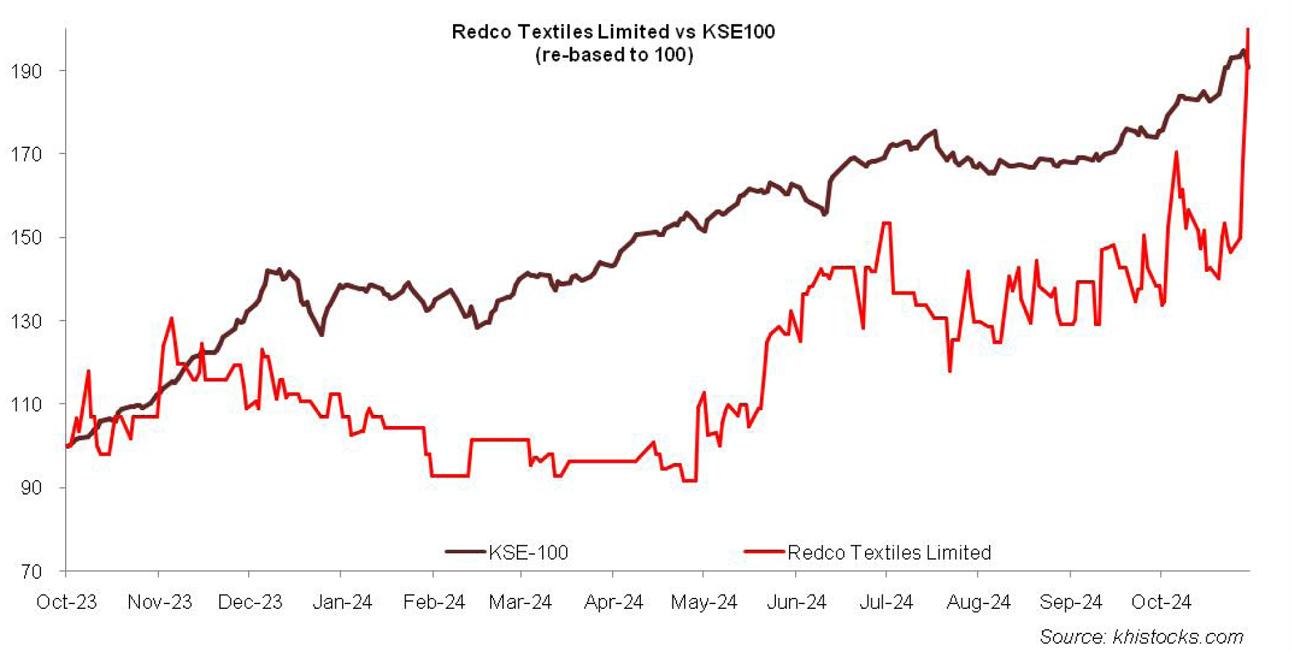

REDCO’s transition towards alternate energy sources will continue to benefit the company by cutting down its costs. Improved prospects of Pakistan’s textile exports on the back of political instability in Bangladesh and international restrictions on China will also augur well for the company and result in improved margins and profitability.

Read the full story at the Business Recorder - Latest News website.