Profit-takers held sway over the Pakistan Stock Exchange (PSX) for the second consecutive session, as its benchmark KSE-100 Index lost another 335 points on Friday.

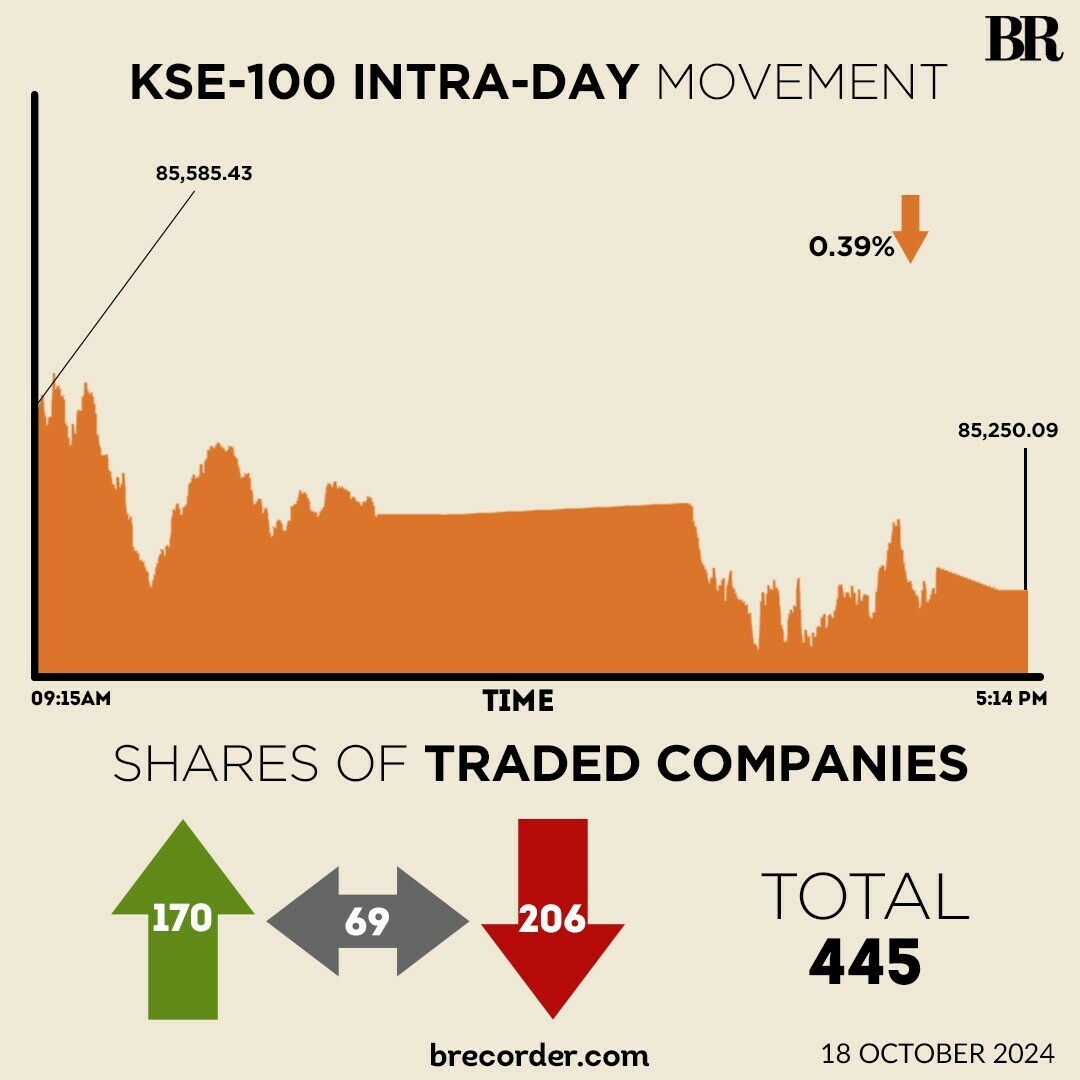

The KSE-100 witnessed range-bound trading in the first half when the bulls took the index to an intra-day high of 85,773.83.

However, cautious investors pushed the index to an intra-day low of 85,120.90 in the second half.

At close, the benchmark index settled at 85,250.09, down by 335.34 points or 0.39%.

“Profit-taking persisted across various sectors. The index experienced pressure throughout the day, closing lower as investors booked gains after recent upward movements,” brokerage house Topline Securities said in its post-market report.

The E&P and fertiliser sectors were the major laggards, losing 225 and 206 points respectively, due to lower-than-expected corporate results, which weighed heavily on overall market sentiment, it added.

On Thursday, the KSE-100 witnessed a bearish session, losing 620 points on profit-taking to close below 86,000.

Pakistan Refinery Limited (PRL), a subsidiary of the Pakistan State Oil Company Limited (PSO), sustained massive losses to the tune of Rs2.35 billion for the quarter ended on September 30, 2024.

During the same period last year, PRL posted a profit-after-tax (PAT) of Rs4.48 billion.

According to a notice to the PSX on Friday, the board of directors met on October 18 to review the company’s financial and operational performance.

Globally, London stocks opened lower on Friday as investors digested an unexpected rise in retail sales data, although both indexes were poised to break a two-week losing streak, buoyed by anticipated Bank of England rate (BoE) cuts and healthy corporate updates.

The blue-chip index was down 0.4% after closing at its strongest level since late May in the previous session, while the domestically-focused FTSE 250 index dropped 0.2% after hitting over a two-week high on Thursday.

Hong Kong stocks rallied more than 3% in the afternoon on Friday as traders welcomed more measures from China to boost the economy and data showing growth beating expectations.

The Hang Seng Index jumped 3.18%, or 637.78 points, to 20,716.88.

The Shanghai Composite Index jumped 2.91%, or 92.18 points, to 3,261.56 and the Shenzhen Composite Index on China’s second exchange piled on 4.09%, or 74.98 points, to 1,906.86.

Meanwhile, the Pakistani rupee recorded marginal improvement against the US dollar, appreciating 0.06% in the inter-bank market on Friday. At close, the currency settled at 277.61, a gain of Re0.18 against the greenback.

Volume on the all-share index decreased to 323.92 million from 513.29 million on Thursday.

The value of shares declined to Rs15.68 billion from Rs21.61 billion in the previous session.

Pak RefineryXD was the volume leader with 28.46 million shares, followed by Hub Power Co with 19.74 million shares, and WorldCall Telecom with 14.95 million shares.

Shares of 455 companies were traded on Friday, of which 170 registered an increase, 206 recorded a fall, while 69 remained unchanged.

Read the full story at the Business Recorder - Latest News website.