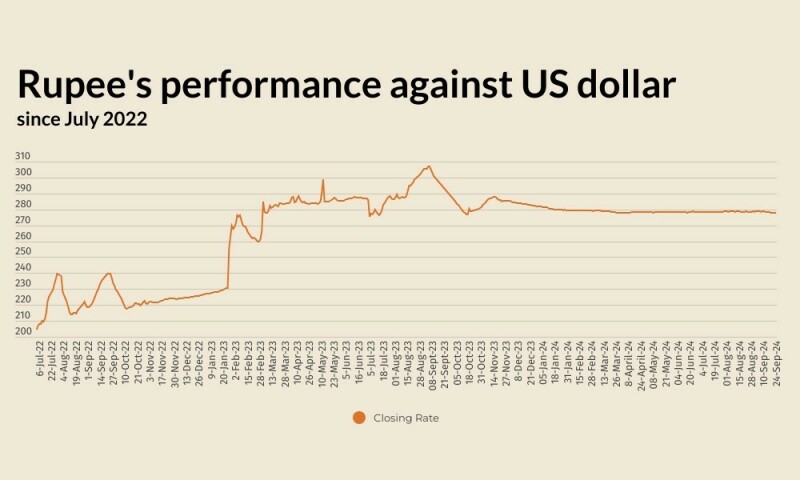

The Pakistani rupee recorded marginal improvement against the US dollar on Tuesday, appreciating 0.03% in the inter-bank market.

At close, the currency settled at 277.80, a gain of Re0.07 against the US dollar.

On Monday, the rupee had settled at 277.87, according to the State Bank of Pakistan (SBP).

The currency market is now factoring in the International Monetary Fund (IMF) Executive Board meeting that is scheduled to take Pakistan’s 37-month Extended Fund Facility (EFF) of about $7 billion on its agenda on September 25.

Globally, the Indian rupee is expected to open little changed to slightly higher on Tuesday amid a dovish Federal Reserve outlook, though the upside is seen largely capped following the price action in the previous session.

The 1-month non-deliverable forward indicated that the rupee will open at 83.53-83.55 to the US dollar compared with 83.5525 in the previous session.

The likelihood of one more 50 basis points rate cut by the U.S. central bank at their next meeting in November is expected to be supportive of rupee and other Asian currencies.

Odds of 50 bps rate cut at that meeting have now climbed to 54% from 30% a week back, per the CME FedWatch Tool. The odds were just 10% a month back

Fed officials on Monday backed more rate cuts to protect the labour market, though the pace at which they will slash borrowing cost remained uncertain.

Focus now turns to Fed Chair Jerome Powell’s remarks on Thursday.

Oil prices, a key indicator of currency parity, jumped more than 2% on Tuesday on news of monetary stimulus from top importer China and concerns that conflict in the Middle East could hit regional supply while another hurricane threatened supply in the United States, the world’s biggest crude producer.

Brent crude futures were up $1.76, or 2.4%, at $75.66 a barrel by 1132 GMT. US WTI crude futures rose $1.84, or 2.6%, to $72.21.

Read the full story at the Business Recorder - Latest News website.