The Pakistan Stock Exchange (PSX) witnessed another bearish session on Thursday as its benchmark KSE-100 Index closed 357 points lower, extending a downturn for the fourth consecutive day.

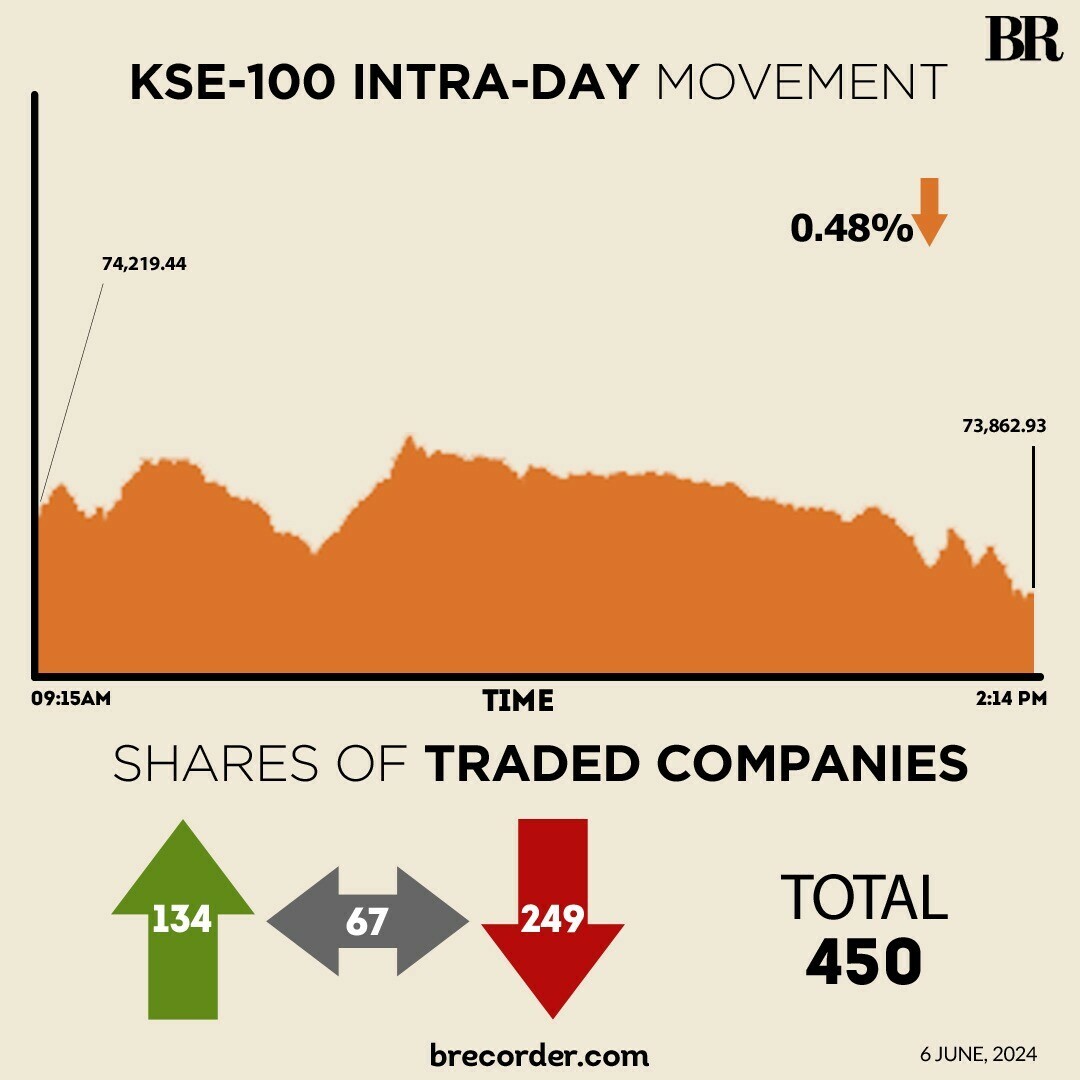

The KSE-100 started the session positive, hitting an intra-day high of 74,593.33.

However, profit-taking soon kicked in and pushed the index into the negative territory.

At close, the benchmark index settled at 73,862.93, down by 356.51 points or 0.48%.

“The selling pressure observed today can be attributed to concerns that the government may raise taxes on dividends, capital gains, and interest income in the upcoming budget,” brokerage house Topline Securities said in its post-market report.

Key contributors to the decline included FFC, OGDC, MARI, MCB, and PSO, which collectively subtracted 136 points from the index. On the flip side, BAFL, SYS, LUCK, ENGRO, and MTL together added 65 points to the index, it added.

On Wednesday, the KSE-100 Index had closed lower by 447 points, mainly on selling in the banking and exploration sectors.

In four sessions this week, the KSE-100 has lost more than 2,000 points.

In a key development, Treet Corporation Limited announced the establishment of a wholly-owned subsidiary in the United Arab Emirates (UAE). The company shared the news in its notice sent to the PSX on Thursday.

In another notice, Pakistan’s e-commerce logistic firm BlueEx Limited informed that it had inked a Memorandum of Understanding (MoU) for a strategic partnership with Shenzhen Cross Border E-commerce Association (SZCBEA), China.

Asian shares gained on Thursday on rising expectations the US Federal Reserve will likely cut interest rates in September, while the euro advanced ahead of the European Central Bank policy meeting where a rate cut is widely expected.

Meanwhile, the Pakistani rupee registered a marginal decline against the US dollar, depreciating 0.03% in the inter-bank market on Thursday. At close, the local unit settled at 278.39, a loss of Re0.09, against the greenback, as per the State Bank of Pakistan.

Volume on the all-share index increased to 352.74 million from 348.55 million a session ago.

The value of shares declined to Rs12.31 billion from Rs16.39 billion in the previous session.

WorldCall Telecom was the volume leader with 17.60 million shares, followed by Kohinoor Spining with 14.85 million shares, and Dewan Motors with 13.69 million shares.

Shares of 450 companies were traded on Thursday, of which 134 registered an increase, 249 recorded a fall, while 67 remained unchanged.

Read the full story at the Business Recorder - Latest News website.